The following transactions apply to Ritter Co. for Year 1: 1. Received $40,000 cash from the issue

Question:

The following transactions apply to Ritter Co. for Year 1:

1. Received $40,000 cash from the issue of common stock.

2. Purchased inventory on account for $128,000.

3. Sold inventory for $200,000 cash that had cost $110,000. Sales tax was collected at the rate of 5 percent on the inventory sold.

4. Borrowed $40,000 from First State Bank on October 1, Year 1. The note had a 6 percent interest rate and a one-year term to maturity.

5. Paid the accounts payable (see transaction 2).

6. Paid the sales tax due on $160,000 of sales. Sales tax on the other $40,000 is not due until after the end of the year.

7. Salaries for the year for one employee amounted to $45,000. Assume the Social Security tax rate is

6 percent and the Medicare tax rate is 1.5 percent. Federal income tax withheld was $5,600.

8. Paid $3,200 for warranty repairs on account during the year.

9. Paid $24,000 of other operating expenses during the year.

10. Paid a dividend of $5,000 to the shareholders.

Adjustments

11. The products sold in transaction 3 were warranted. Ritter estimated that the warranty cost would be 3 percent of sales.

12. Record the accrued interest at December 31, Year 1.

13. Record the accrued payroll tax at December 31, Year 1. Assume no payroll taxes have been paid for the year and that the unemployment tax rate is 6.0 percent (the federal unemployment tax rate is 0.6 percent and the state unemployment tax rate is 5.4 percent on the first $7,000 of earnings per employee).

Required

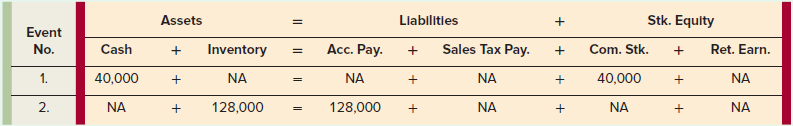

a. Create an accounting equation. Record the events under the equation. Number the entries with the related event numbers. The following is a partial list of accounts with the first two events shown as examples. Create new accounts as needed to record the events. The final solution should have 21 accounts. Use parentheses to indicate decreases to an account.

b. Prepare an income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for Year 1.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds