The specialist hedge fund strategy that Mukilteo plans to recommend is most likely: A. cross-asset volatility trading

Question:

The specialist hedge fund strategy that Mukilteo plans to recommend is most likely:

A. cross-asset volatility trading between the US and Japanese markets.

B. selling equity volatility and collecting the volatility risk premium.

C. buying longer-dated out-of-the-money options on VIX index futures.

Snohomish Mukilteo is a portfolio analyst for the Puyallup-Wenatchee Pension Fund (PWPF). PWPF’s investment committee (IC) asks Mukilteo to research adding hedge funds to the PWPF portfolio.

A member of the IC meets with Mukilteo to discuss hedge fund strategies. During the meeting, the IC member admits that her knowledge of hedge fund strategies is fairly limited but tells Mukilteo she believes the following:

Statement 1: Equity market-neutral strategies use a relative value approach.

Statement 2: Event-driven strategies are not exposed to equity market beta risk.

Statement 3: Opportunistic strategies have risk exposure to market directionality.

The IC member also informs Mukilteo that for equity-related strategies, the IC considers low volatility to be more important than negative correlation.

Mukilteo researches various hedge fund strategies. First, Mukilteo analyzes an eventdriven strategy involving two companies, Algona Applications (AA) and Tukwila Technologies (TT). AA’s management, believing that its own shares are overvalued, uses its shares to acquire TT. The IC has expressed concern about this type of strategy because of the potential for loss if the acquisition unexpectedly fails. Mukilteo’s research reveals a way to use derivatives to protect against this loss, and he believes that such protection will satisfy the IC’s concern.

Next, while researching relative value strategies, Mukilteo considers a government bond strategy that involves buying lower-liquidity, off-the-run bonds and selling higher-liquidity, duration-matched, on-the-run bonds.

Mukilteo examines an opportunistic strategy implemented by one of the hedge funds under consideration. The hedge fund manager selects 12 AAA rated corporate bonds with actively traded futures contracts and approximately equal durations. For each corporate bond, the manager calculates the 30-day change in the yield spread over a constant risk-free rate. He then ranks the bonds according to this spread change. For the bonds that show the greatest spread narrowing (widening), the hedge fund will take long (short) positions in their futures contracts. The net holding for this strategy is market neutral.

Mukilteo also plans to recommend a specialist hedge fund strategy that would allow PWPF to maintain a high Sharpe ratio even during a financial crisis when equity markets fall.

The IC has been considering the benefits of allocating to a fund of funds (FoF) or to a multi-strategy fund (MSF). Mukilteo receives the following email from a member of the IC:

“From my perspective, an FoF is superior even though it entails higher managerspecific operational risk and will require us to pay a double layer of fees without being able to net performance fees on individual managers. I especially like the tactical allocation advantage of FoFs—that they are more likely to be well informed about when to tactically reallocate to a particular strategy and more capable of shifting capital between strategies quickly.”

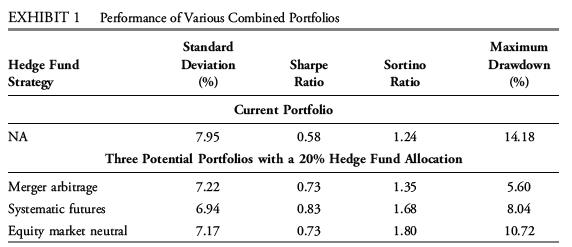

Finally, Mukilteo creates a model to simulate adding selected individual hedge fund strategies to the current portfolio with a 20% allocation. The IC’s primary considerations for a combined portfolio are (1) that the variance of the combined portfolio must be less than 90% of that of the current portfolio and (2) that the combined portfolio maximize the riskadjusted return with the expectation of large negative events. Exhibit 1 provides historical performance and risk metrics for three simulated portfolios.

Step by Step Answer: