Before January 1, 2005, Norwegian Telenor ASA prepared its financial statements according to Norwegian Generally Accepted Accounting

Question:

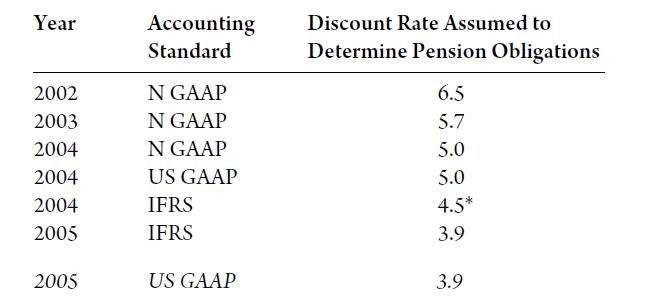

Before January 1, 2005, Norwegian Telenor ASA prepared its financial statements according to Norwegian Generally Accepted Accounting Principles (N GAAP). Starting in 2005, Telenor ASA used International Financial Reporting Standards (IFRS). Telenor also provided reconciliation to U.S. GAAP. Telenor has a defined benefit pension plan and therefore needs to assume a discount rate to determine its pension benefit obligations.

At the end of 2005, the same discount rate is used for both IFRS and US GAAP. At the end of 2004, a lower discount rate is used under IFRS than for US GAAP. For US GAAP the discount rate included an assumed risk premium for corporate rate bonds over the Norwegian government bond rate. At the end of 2005, assume that the more conservative government bond rate could also be used as the discount rate for US GAAP. Application of a more conservative approach to determining theUS GAAP discount rate is regarded as a change in estimate (Telenor 2005).

Discuss the effect of lower assumed discount rates on the pension obligations and whether Telenor should apply different discount rates when reporting 2004 fiscal year performance under IFRS and U.S. GAAP.

Step by Step Answer: