Suppose there is a stock and a bond governed by the equations It is desired to construct

Question:

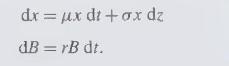

Suppose there is a stock and a bond governed by the equations

It is desired to construct a portfolio of these two securities that gives the maximum expected \(\log\) of return. However, although \(\sigma\) and \(r\) are known with certainty, the parameter \(\mu\) is uncertain. The best estimate of \(\mu\) is of the form \(\hat{\mu}=\mu+\epsilon\), where \(\epsilon\) has zero mean and variance \(w^{2}\).

(a) Let \(\alpha\) be the fraction of the wealth invested in the stock at any time and \(1-\alpha\) be the fraction invested in the bond. If \(\mu\) were known exactly and \(\alpha\) is given, what would be the equation governing the portfolio return \(\mathrm{d} P / P\) ?

(b) What is the optimal expected log return that would correspond to knowing \(\mu\) exactly? Call it \(R_{O}\).

(c) If you believe that \(\hat{\mu}\) is the true \(\mu\) and use it to determine \(\alpha\), what will you think (on average) is the optimal expected log return? Call it \(R_{T}\). How does it compare with \(R_{O}\) ?

(d) If you use the estimate \(\hat{\mu}\) to find \(\alpha\), what is the actual log return that on average you will get? Call it \(R_{A}\). How does it compare with \(R_{O}\) ?

(e) Suppose \(\hat{\mu}\) is estimated as equal to the average log return of the stock over \(n\) years. What will be the ratio \(w^{2} / \sigma^{2}\) ? If the estimate uses 5 years of data and the expected optimal log return is \(15 \%\) per year, what are the values of \(R_{T}\) and \(R_{A}\) ?

Step by Step Answer: