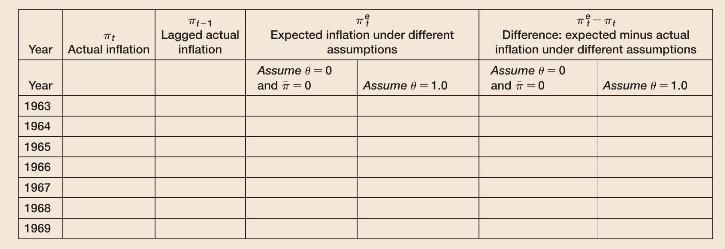

The rate of inflation and expected inflation in different decades Fill in the values in table below

Question:

The rate of inflation and expected inflation in different decades Fill in the values in table below for inflation and expected inflation using the 1960s. Here you will have to find the data using the FRED data base operated by the Federal Reserve Bank of St. Louis. The series are found in Question 9. You will have the most success using a spreadsheet. From the 1960's:

a. Is zero a good choice for the value of \(\theta\) in the 1960s? Is \(\bar{\pi}=0\) a good choice for a value of \(\bar{\pi}\) ? How are you making these judgements?

b. Is 1 a good choice for the value of \(\theta\) in the 1960s? How are you making that judgement?

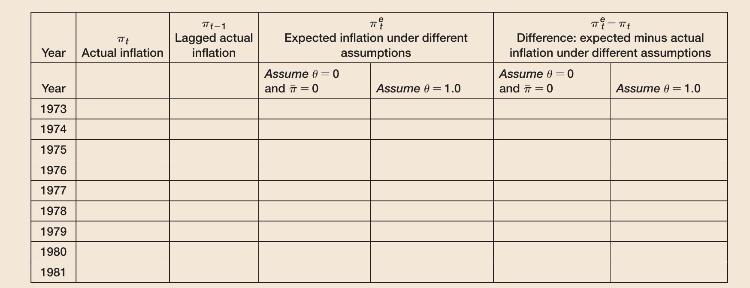

c. Is zero a good choice for the value of \(\theta\) or \(\bar{\pi}\) in the 1970s? How are you making that judgement?

d. Is 1 a good choice for the value of \(\theta\) in the 1970s? How are you making that judgement?

e. How do you compare the behavior of inflation, its average level and its persistence across these two time periods?

Fill in the values in the table below for inflation and expected inflation using the 1970s and 80s. You will have the most success using a spreadsheet From the 1970's and 1980's:

Data from question 9

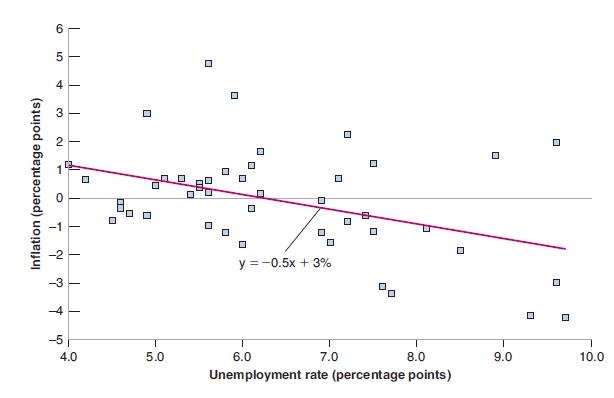

Using the natural rate of unemployment to predict changes in inflation The estimated Phillips curve from Figure 8.4 is

\[

\pi_{t}-\pi_{t-1}=3.0-0.5 u_{t}

\]

Fill in the table below using the data collected in Question 6. You will want to use a spreadsheet.

Figure 8.4

Data from question 6

The macroeconomic effects of the indexation of wages Suppose that the Phillips curve is given by

\[

\pi_{t}-\pi_{t}^{e}=0.1-2 u_{t}

\]

where

\[

\pi_{t}^{e}=\pi_{t-1}

\]

Suppose that inflation in year \(t-1\) is zero. In year \(t\), the central bank decides to keep the unemployment rate at \(4 \%\) forever.

Step by Step Answer: