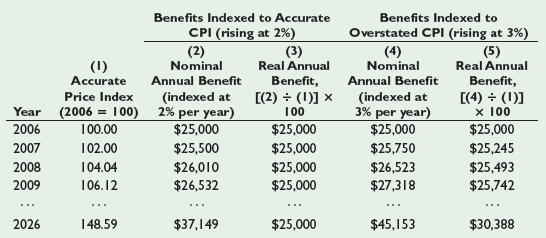

As in the following table, consider someone who retired in 2006 with $25,000 in initial Social Security

Question:

a. What would the real benefit payment be in 2026?

b. What would be the total percentage increase in the real benefit payment from 2006 to 2026?

Transcribed Image Text:

Benefits Indexed to Accurate Benefits Indexed to CPI (rising at 2%) Overstated CPI (rising at 3%) (2) Nominal (3) Real Annual (4) Nominal (5) Real Annual (1) Accurate Benefit, [(2) ÷ (1)] × 100 Annual Benefit Annual Benefit Benefit, Price Index (indexed at 2% per year) $25,000 (indexed at 3% per year) $25,000 [(4) ÷ (1)] x 00 $25,000 Year (2006 = 100) 2006 100.00 $25,000 2007 102.00 $25,500 $25,000 $25,750 $25,245 $25,493 $25,742 2008 104.04 $26,010 $26,532 $25,000 $25,000 $26,523 $27,318 2009 106.12 ... 2026 148.59 $37,149 $25,000 $45,153 $30,388

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

a The nominal benefit payment with overstated CPI would be ...View the full answer

Answered By

Mamba Dedan

I am a computer scientist specializing in database management, OS, networking, and software development. I have a knack for database work, Operating systems, networking, and programming, I can give you the best solution on this without any hesitation. I have a knack in software development with key skills in UML diagrams, storyboarding, code development, software testing and implementation on several platforms.

4.90+

63+ Reviews

152+ Question Solved

Related Book For

Macroeconomics Principles and Applications

ISBN: 978-1111822354

6th edition

Authors: Robert E. Hall, Marc Lieberman

Question Posted:

Students also viewed these Business questions

-

In the following table, we consider how Alex, Tyler, and Monique would fare under la carte pricing and under bundling for cable TV when there are two channels: Lifetime and the Food Network. Alex...

-

Suppose someone convinces you that the relationship between business expenditure for new plant and equipment and sales is as follows: where Y is desired expenditure and X is desired or expected...

-

a. Create a network flow model for this problem. (Consider inserting intermediate nodes in your network to assist in meeting the minimum monthly purchase restrictions for each supplier and the...

-

Determine whether the given series is absolutely convergent, conditionally convergent, or divergent. (2) n=1 (1)n-1 n (c) (1)n3/n n=1 (b) n=1 (1)n-1 nn

-

Explain why an item may pass the definition test but fail the recognition criteria for a liability?

-

A power transmission system is modeled as shown in Fig. 9.92. Given the following; Source voltage ............................... Vs = 115 0o V, Source impedance ........................... Zs = 1 +...

-

The 150-kg bucket is suspended from end E of the frame. If the diameters of the pins at A and D are 6 mm and 10 mm, respectively, determine the average shear stress developed in these pins. Each pin...

-

LaToya Company produces door pulls, which are inspected at the end of production. Spoilage may occur because the door pull is improperly stamped or molded. Any spoilage in excess of 3 percent of the...

-

Check my work As the chief financial officer of Adirondack Designs, you have the following information: Next year's expected net income after tax but before new financing Sinking-fund payments due...

-

Muskoka Boys Shaving Co. ("MBSC") is a GST/HST registrant operating an online store in Ontario's cottage country region. The company specializes in selling fine grooming products for men. It is June...

-

During the late 19th and early 20th centuries, many U.S. farmers favored inflationary government policies. Why might this have been the case?

-

In December 2008, some economists forecast deflation for the coming yeara decrease in the price level, and therefore a negative inflation rate. Suppose a lender at that time expected deflation over...

-

Due to rapid employee turnover in the accounting department, the following transactions involving intangible assets were recorded in a questionable way by Hahn Company in the year ended August 31,...

-

Given the linear partial differential equation tu- dr Ju du -5u- +7u==0 drt dt du(0, t) t use the technique of separation of variables to re-write the partial differ- ential equation and the boundary...

-

Use either IP or CP (or both) and the eighteen rules of inference to derive the conclusions of the following symbolized arguments. You may not use the Direct Method. (15) Find: G ~1 1. FVG 2. H.(IF)...

-

Define at least two ethical principles that should be utilized in online dispute resolution between either businesses and customers or between businesses and other businesses. What is the importance...

-

Prepare a written description / overview of your preferred HCO Operations Management topic. The topic needs to include the specific type of HC organization as well as the operations management issue...

-

You are CEO of SUNSUP Corporation, a major innovator and manufacturer of solar panels. As part of SUNSUP's commitment to social responsibility, you initiated and led, between 2017 and 2022, the...

-

Derive the relation quoted in eq. (17.7) ? between the binding energy of a neutral atom B(Z, A) and its mass excess ?(Z, A). B(Z, A) - n) + (| ) -(, A)

-

White Bolder Investments (WBI) You are an intern working for WBI, a large investment advisory services in Sydney. Among other regular customers, WBI has been providing advisory services for Jumbo...

-

Suppose that Pattys Pool has the demand data given in Table in the chapter. Further, suppose that Patty has just two types of costs: (1) rent of $25 per day and (2) towel service costs equal to 50...

-

In Figure, the equation for each countrys demand curve is QD = 160 40 P, where QD represents millions of doses. Use this demand equation to answer the following questions: a. Suppose the price...

-

Suppose that Pattys Pool has the demand data given in Table. Further, suppose that Patty has just two types of costs: (1) rent of $24 per day and (2) towel and other service costs equal to $5 per...

-

What interventions are the most beneficial to the clients your agency serves? Explain

-

Using the following predicates: square (x) is true if x is a square (otherwise it is false) star (x) is true if x is a star (otherwise it is false) circ(x) is true if x is a circle (otherwise it is...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any common stock during the year. A total of...

Study smarter with the SolutionInn App