At last, I can see some light at the end of the tunnel, said Steve Adams, managing

Question:

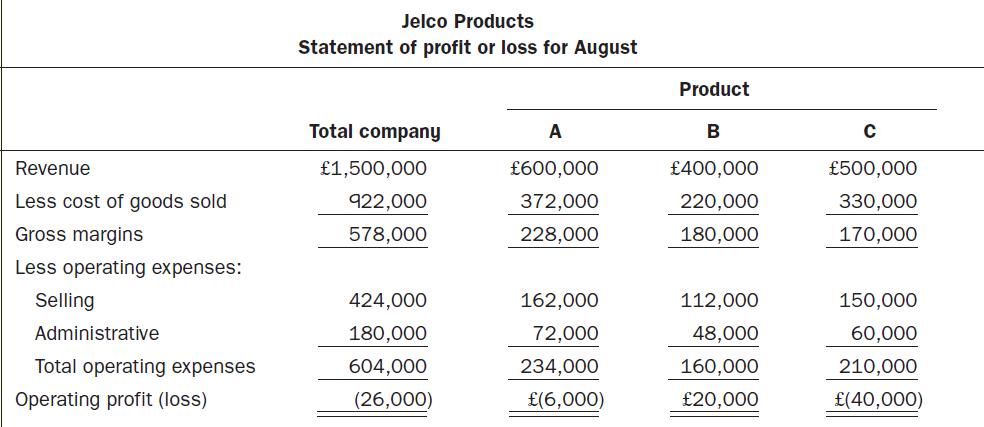

‘At last, I can see some light at the end of the tunnel,’ said Steve Adams, managing director of Jelco Products. ‘Our losses have shrunk from over £75,000 a month at the beginning of the year to only £26,000 for August. If we can just isolate the remaining problems with products A and C, we’ll be in the black by the first of next year.’ The company’s statement of profit or loss for the latest month (August) is presented below (absorption costing basis):

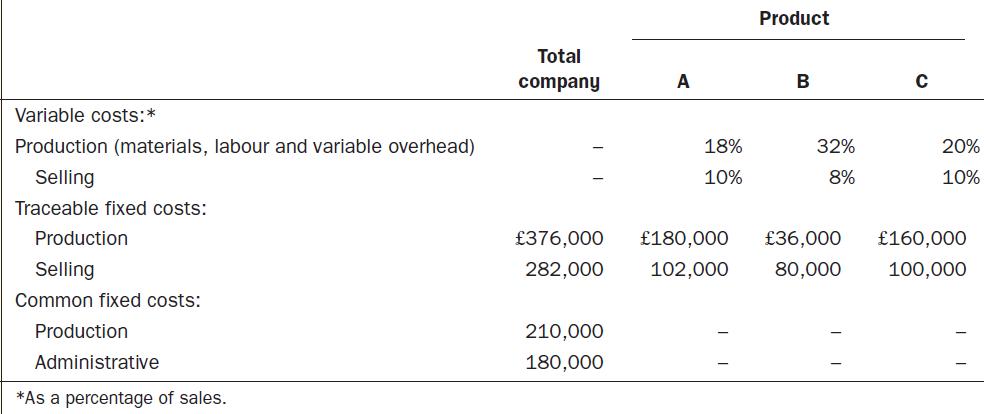

‘What recommendations did that business consultant make?’ asked Mr Adams. ‘We paid the guy £100 an hour; surely he found something wrong.’ ‘He says our problems are concealed by the way we make up our statements,’ replied Sally Warren, the deputy managing director. ‘He left us some data on what he calls “traceable” and “common” costs that he says we should be isolating in our reports.’ The data to which Ms Warren was referring are shown as follows:

‘I don’t see anything wrong with our statements,’ said Mr Adams. ‘Bill, our chief accountant, says that he has been using this format for over 30 years. He’s also very careful to allocate all of our costs to the products.’ ‘I’ll admit that Bill always seems to be on top of things,’ replied Ms Warren. ‘By the way, Purchasing says that the X7 chips we use in products A and B are on back order and won’t be available for several weeks. From the looks of August’s statement of profit or loss, we had better concentrate our remaining inventory of X7 chips on product B.’ (Two X7 chips are used in both product A and product B.) The following additional information is available on the company:

1. Work in progress and finished goods inventories are negligible and can be ignored.

2. Products A and B each sell for £250 per unit, and product C sells for £125 per unit. Strong market demand exists for all three products.

Required

1. Prepare a new statement of profit or loss for August, segmented by product and using the contribution approach. Show both amount and percentage columns for the company in total and for each product.

2. Assume that Mr Adams is considering the elimination of product C due to the losses it is incurring. Based on the statement you prepared in Requirement 1 above, what points would you make for or against elimination of product C?

3. Do you agree with the company’s decision to concentrate the remaining inventory of X7 chips on product B? Why or why not?

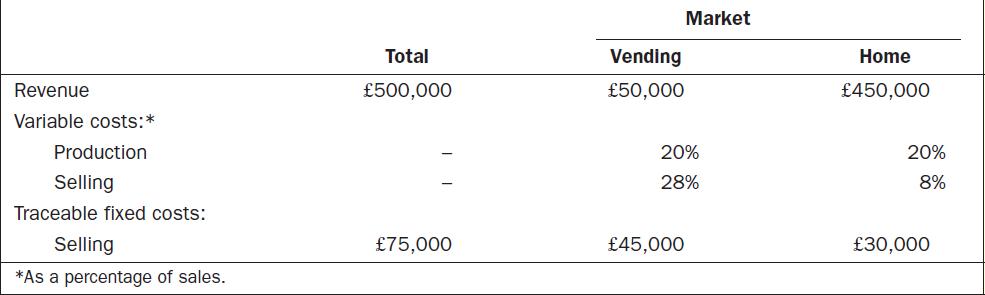

4. Product C is sold in both a vending and a home market with revenue and cost data as follows:

The remainder of product C’s fixed selling costs and all of product C’s fixed production costs are common to the markets in which product C is sold.

(a) Prepare a statement of profit or loss showing product C segmented by market. Use the contribution approach and show both amount and percentage columns for the product in total and for each market.

(b) Which points revealed by this statement would you be particularly anxious to bring to the attention of management?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen