Raddington Industries produces tool and die machinery for manufacturers. The company expanded vertically several years ago by

Question:

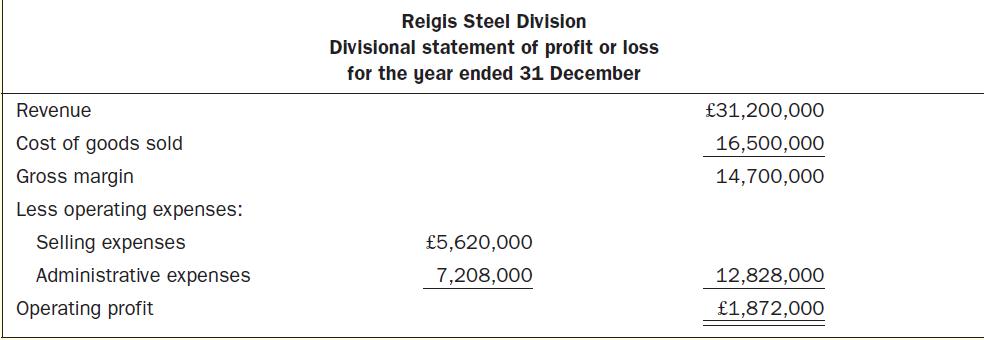

Raddington Industries produces tool and die machinery for manufacturers. The company expanded vertically several years ago by acquiring Reigis Steel Company, one of its suppliers of alloy steel plates. Raddington decided to maintain Reigis’s separate identity and therefore established the Reigis Steel Division as one of its investment centres. Raddington evaluates its divisions on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum rate of return of 11%. Reigis’s ROI has ranged from 14 to 17% since it was acquired by Raddington. Recently, Reigis encountered an investment opportunity that would yield an estimated rate of return of 13%. Reigis’s management decided against the investment because it believed the investment would decrease the division’s overall ROI. Last year’s statement of profit or loss for Reigis Steel Division is given below. The division’s operating assets employed were £12,960,000 at the end of the year, which represents an 8% increase over the previous year-end balance.

Required

1. Compute the following performance measures for the Reigis Steel Division:

(a) ROI. (Remember, ROI is based on the average operating assets, computed from the beginning-of-year and end-of-year balances.) State ROI in terms of margin and turnover.

(b) Residual profit.

2. Would the management of Reigis Steel Division have been more likely to accept the investment opportunity it had last year if residual profit were used as a performance measure instead of ROI? Explain.

3. The Reigis Steel Division is a separate investment centre within Raddington Industries. Identify the items Reigis must be free to control if it is to be evaluated fairly by either the ROI or residual profit performance measures.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen