Eyre Watches Ltd is a watch manufacturing company that has been in this business for the past

Question:

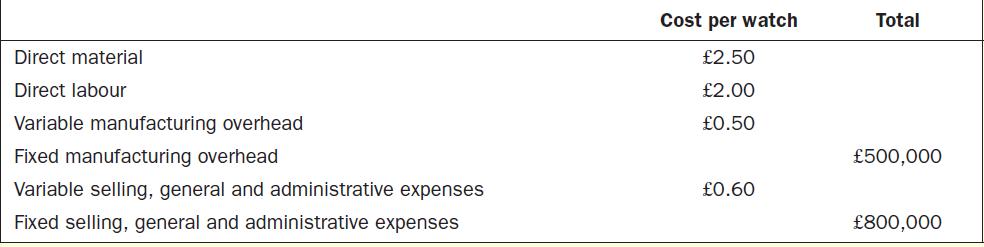

Eyre Watches Ltd is a watch manufacturing company that has been in this business for the past 15 years. It started its children’s watch division 11 years ago. Information regarding the company’s situation and performance at different time periods is given below. Year of inception (Year 1): Eyre Watches Ltd manufactures wristwatches for men and women. In the current year, the company has decided to manufacture and sell digital wristwatches for children. The accounting department of the company has estimated the following costs per children’s watch:

Eyre Watches Ltd is required to invest £5,000,000 for manufacturing children’s watches. The company requires a return on investment (ROI) of 20%. The company intends to use the absorption costing approach to set the selling price for one children’s watch. According to a market survey conducted by Eyre Watches, the company expects to sell 500,000 children’s watches in the first year. During the third year: Sales of children’s watches have risen by 10% compared to the budgeted sales at Year 1. Eyre Watches Ltd is planning to increase the price of children’s watches. The management believes that the increase in price should be based only on variable costs as the company’s fixed costs would not have changed in the past three years. The management of the company also understands that the change in the selling price will affect the product’s demand. Hence, they want to set the selling price in such a way that the change in price and the demand will have no effect on profits. The company’s marketing department has conducted some market research to determine the price elasticity of demand of children’s watches. According to the research, an increase in the price of children’s watches by 5% will decrease demand by 10%.

During the tenth year: Eyre Watches Ltd is facing tough competition from many companies. Because of increased competition, Eyre Watches Ltd is losing its market for children’s watches. Market research suggests that Eyre Watches is losing sales because of its selling price. Competitors of the company are selling children’s watches at a much lower price. The research also suggests that the company will be able to sell 750,000 units if it decreases the selling price to £8. However, if the company continues with the same selling price it will be able to sell only 250,000 units. Management has informed the production department to come up with a strategy to reduce the costs per

children’s watch.

Required

1. Calculate the target selling price of one children’s watch.

2. Did Eyre Watches Ltd incur a net operating loss or a net operating profit and of how much?

3. Calculate the price elasticity of demand for children’s watches in the third year.

4. Calculate the profit-maximizing selling price for children’s watches in the third year.

5. Calculate the return on investment (ROI) from the children’s watch division in the third year if Eyre Watches Ltd does not change the selling price.

6. What will be the net operating profit from the children’s division?

7. What will be the return on investment (ROI) from the children’s watch division?

8. What will be the target cost to produce a children’s watch?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen