Serenity Solutions Ltd is a multinational conglomerate. Some of the subsidiaries of Serenity Solutions Ltd are Serenity

Question:

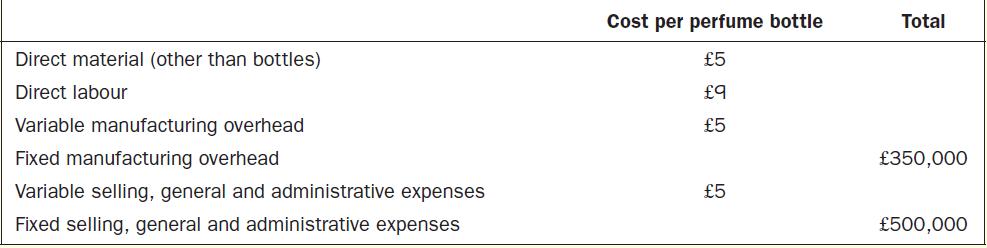

Serenity Solutions Ltd is a multinational conglomerate. Some of the subsidiaries of Serenity Solutions Ltd are Serenity Glassware Ltd, Serenity Healthcare Ltd, Serenity Personal Care Ltd, Serenity Bags Ltd, Serenity Cements Ltd and Serenity Plastics Ltd. Serenity Glassware Ltd manufactures and sells various glassware, including vases, crockery, perfume bottles, mugs, etc. Serenity Personal Care Ltd manufactures and sells personal care products. One of its most popular personal care products is fragrances. The personal care division currently manufactures and sells fragrances for men. Recently, this division started manufacturing perfumes for women. However, the company has decided to start with only one type of women's perfume. Based on the response it receives for this product, the company plans to expand the product line. The company has decided on a standard size of 50 ml for women's perfume. The company has invested £1,500,000 to start this new product line. It has raised funds by issuing new equity shares. It hopes for a return on investment of 10%. The budgeted manufacturing and selling, general and administrative expenses for a month are given below. The estimated number of perfume bottles manufactured and sold in a month is 50,000.

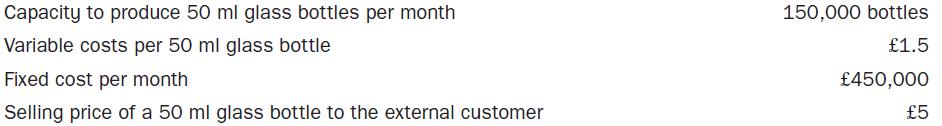

The personal care division purchases glass bottles for its perfumes from an outside vendor, Reflector Glassware Ltd. However, for the women’s perfume division, the company has to decide whether to buy the bottles from Serenity Glassware Ltd or from Reflector Glassware Ltd. Reflector Glassware Ltd has quoted £4.50 per bottle. Serenity Glassware Ltd has a huge customer base for glass perfume bottles. It sells 125,000 units of 50 ml bottles in a month. The details for Serenity Glassware Ltd are given below:

1. What is the lowest acceptable transfer price for Serenity Glassware Ltd?

2. Serenity Personal Care Ltd and Serenity Glassware Ltd agree to set the transfer price at £3.50. Determine if the contribution margin earned by Serenity Glassware Ltd from internal transfer is lower than or higher than the contribution margin earned by selling the glass bottles to external customers and by how much?

3. Serenity Personal Care Ltd and Serenity Glassware Ltd agree to set the transfer price at £3.50. Determine the cost savings arising from this internal transfer for the personal care division.

4. Managers of Serenity Personal Care Ltd and Serenity Glassware Ltd agree to set the transfer price at £3.50. Determine the increase or decrease in profit due to the internal transfer for Serenity Solutions Ltd.

5. If Serenity Glassware Ltd and Serenity Personal Care Ltd agree to set the transfer price at absorption cost incurred by Serenity Glassware Ltd, will Serenity Glassware recover the entire cost incurred to produce the product?

6. Determine the ideal transfer price for the transfer of glass bottles from Serenity Glassware Ltd to Serenity Personal Care Ltd.

7. Serenity Glassware Ltd had an idle capacity of 25,000 units. However, one of the external customers has cancelled its contract with Serenity Glassware Ltd. This external customer used to purchase 30,000 glass bottles. Based on the cancellation of contract with the external customer, if Serenity Personal Care Ltd proposes to purchase 50,000 glass bottles at £1.75 per unit, determine if Serenity Glassware Ltd should accept the proposal.

8. In the first year, the glassware division and the personal care division agree to set the transfer price at £3.25. In the second year, the personal care division proposes to buy 95,000 glassware bottles at the same rate. Calculate the transfer price for the glassware division if the proposal is accepted.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen