Harplast produces over 120 varieties of plastic products, from pacifiers and milk bottles to toilet seats and

Question:

Harplast produces over 120 varieties of plastic products, from pacifiers and milk bottles to toilet seats and plastic boxes for industrial storage. Harplast's CEO needs to make a decision in the face of a new bid opportunity. This opportunity needs to be analysed in the context of a high unused production capacity, namely 50%, and the long-term strategy of implementing the European framework for quality management (EFQM). The CEO finds the implementation of these standards to be crucial for the survival of the company as market research has shown that one major reason for losing bids is the lack of such quality certifications, which leads to increased unused capacity. On the other hand, the CEO needs to find the resources to invest in such an implementation, but at the moment there is not much profit available for reinvestment. The statement of financial position at the end of 2017 presents the following results:

At the end of each year, the company pays out part of the principal. The yearly interest expense amounts to €3,360,000.00. The interest is recorded quarterly, but is paid at the end of the year. The value chain inside Harplast consists of: production, assembly, testing, packing and shipment. The production process starts with choosing the moulds to be utilized and the melting of the polyurethane. If the moulds are not available, the engineers create or purchase one. The machine utilization is very inefficient and unpredictable, as the machines are old and break down multiple times, leading to an average of 45% downtime. Even if this is an automated process, with an average of 3 machine minutes per finished product, there is an engineer that needs to be there during the entire production process. After the moulding phase, if the products are made of multiple modules that need to be assembled, they are sent to the assembly line, and then sent to the testing department, where, depending on the product, the testing can take between 3 minutes and 10 seconds. The products that are considered inadequate are sent back to the melting section, as the plastic can be reused. This means there is no material waste. One kilogram of polyurethane costs €1.50. Every year, based on the expected demand, Harplast negotiates the payment conditions with their suppliers. Harplast will have to pay the entire purchase cost in four installments, at the end of each quarter.

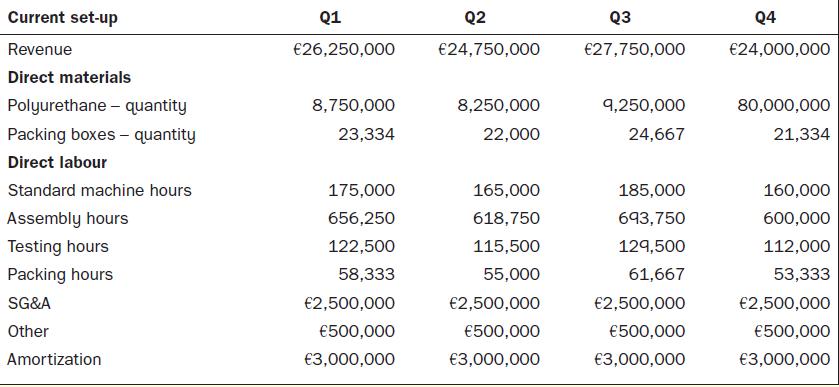

The machine engineers are paid €7 per labour hour, while the testing and assembling department employees are paid €6 per labour hour and packing department employees are paid €5.70 per labour hour. All employees are paid at the end of the month, according to their labour hours. In order to make the packing operations more efficient, Harplast is shipping the products in standard boxes sized 45×45×45cm. One box costs €0.50. Harplast purchases the boxes from one supplier and pays once per quarter. With the current set-up, the production planning of the company shows the following expected results:

Harplast has a 70% to 30% collection pattern, with 70% of revenues being collected within the same quarter of the sales and 30% of revenues being collected in the following quarter.

The CEO is contemplating the following bidding opportunity from a new client - PureAir. Harplast has been asked to bid for 60,000 units of hard plastic shell for an air-purification device, to be delivered at a rate of 15,000/quarter.

The CEO knows that if Harplast is to be competitive, they need to offer a €5/unit selling price. In order to produce this shell, Harplast needs to acquire a new mould which costs €15,000. Furthermore, the CEO is contemplating buying a new machine at €9,500,000 in order to stick to the strategic plan of EFQM that he is accountable for in front of the shareholders. The yearly production capacity of this machine is 180,000 units

with a downtime of 5% required for adequate maintenance and cleaning. If the machine is put in function, the

engineers will only need to be present for regular inspections, which means that the machine cost/hour would

be €1.15. The new machine has a useful life of 30 years. The machine would also partly replace an existing

machine.

To produce one hard shell Harplast will use:

• 3 kg of polyurethane

• 0 assembly hours, as it is a 1-module product

• 2 minutes of testing/product

• 1 box that holds 100 units

The bid seems very appealing to the CEO; however, he is worried if he should go forward, as in order to make

the investment, he would need to negotiate with his suppliers to pay for the mould in 4 installments and he will

need to take a five-year loan at a 10% interest rate to purchase the new machine.

Required

The CEO has asked you:

1. What are Harplast’s quarterly profits, based on the current set-up?

2. Based on the current set-up, calculate the cash flow and analyse the liquidity of the company for each quarter. Is there anything Harplast should be concerned about?

3. Identify all relevant revenues and costs for the bidding opportunity. How does this bidding opportunity influence the cash flow of the company?

4. What are the positive and negative aspects of Harplast’s financial situation that would help or hinder the negotiation with the banks?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen