JLB Ltd is a small, private company which makes a range of household furniture. The company prides

Question:

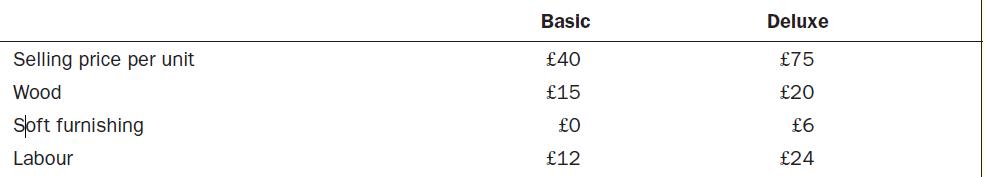

JLB Ltd is a small, private company which makes a range of household furniture. The company prides itself on sourcing local, ethical raw materials and supporting projects in the local community. Division C makes two models of dining chair, the basic and the deluxe. Details of costs for each model are as follows:

The basic model takes 1.5 hours to make and the more complicated deluxe model takes 3 hours to make. Budgeted production and sales for the next year is 4,000 units of the basic model at £40 each and 1,000 units of the deluxe model at £75 each. Division C has overheads of £54,000.

Required

1. Calculate the overhead absorption rate based on labour hours.

2. Calculate the budgeted contribution for Division C.

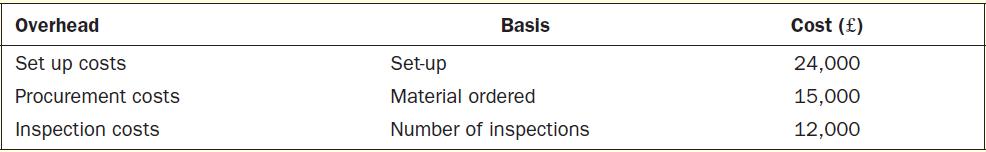

3. What is the budgeted profit for Division C by each type of chair using the overhead absorption rate calculated above? A consultant management accountant has been working with JLB Ltd to determine the true overhead costs for the company. For Division C, they have analysed the £54,000 overhead into the following:

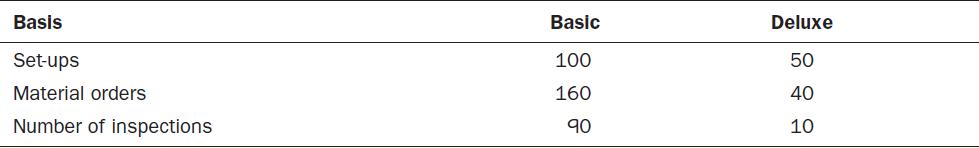

Note that there is still £3,000 of overhead that cannot be further analysed and will be based on labour hours. The activity levels for the two models of chair are as follows:

4. Calculate the cost per activity for each activity

5. Using ABC, how would the set-up costs be allocated to the two different models made by Division C?

6. Using ABC, how would the procurement costs be allocated to the two different models made by Division C?

7. Using ABC, what is the cost per unit for the inspection costs?

8. Using ABC, what are the overheads allocated to each product?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen