Targit Ltd manufacture a range of garden furniture. One of their products is a garden lounge chair,

Question:

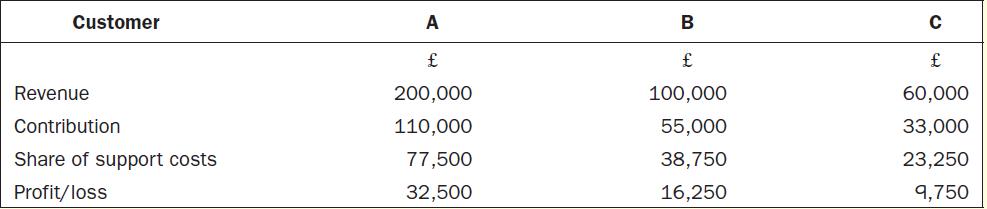

Targit Ltd manufacture a range of garden furniture. One of their products is a garden lounge chair, which Targit sells to customers for £40, generating £22 of contribution for Targit. There are three customers for the chair and Targit delivers to these customers. A is the distribution centre for a national catalogue store. B is the nearest branch of a regional department store. C is a local garden centre. Analysis of revenue and profit by customer is as follows:

The support costs are currently allocated in proportion to the sales volume.

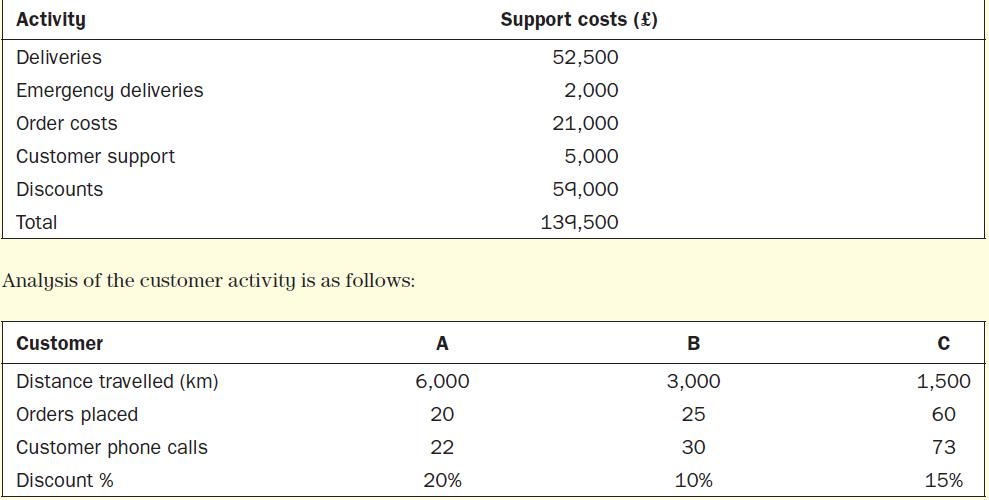

Staff in the support centre are concerned that the current allocation is incorrect. The three customers are in different locations, and they use varying amounts of activities which are pooled in the support costs. In addition, the three customers have different discounts given to them. The discounts are absorbed into support costs, rather than being allocated to the individual customers. The support centre staff have suggested that customer C (the local garden centre) is taking a disproportionate amount of their time and therefore should have greater support costs allocated to them. They have provided a breakdown of support costs and an analysis of customer activity. A breakdown of the support costs is as follows:

In addition, customer C had 4 emergency deliveries at a cost of £500 each. The information will allow Targit to use activity-based costing to allocate the support costs to the three customers.

Required

1. Identify the correct allocation of the discounts for the customers using ABC.

2. Calculate the allocation of the delivery costs using ABC.

3. Calculate the allocation for the order costs using ABC.

4. Calculate the allocation for customer support (based on phone calls).

5. Using the information you have calculated, describe what you know about Activity Based Costing.

6. Calculate the profit per customer using activity-based costing. Discuss your findings.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen