Margit Andersen purchased a used car for 10,000 at the beginning of last year and incurred the

Question:

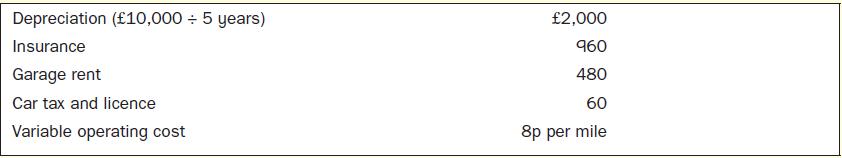

Margit Andersen purchased a used car for £10,000 at the beginning of last year and incurred the following operating costs:

The variable operating costs consist of petrol, oil, tyres, maintenance and repairs. Margit estimates that at her current rate of usage the car will have zero resale value in five years, so the annual straight-line depreciation is £2,000. The car is kept in a garage for a monthly fee.

Required

1. Margit drove the car 10,000 miles last year. Compute the average cost per mile of owning and operating the car.

2. Margit is unsure about whether she should use her own car or rent a car to go on an extended crosscountry trip for two weeks during spring break. What costs above are relevant in this decision? Explain.

3. Margit is thinking about buying an expensive sports car to replace the car she bought last year. She would drive the same number of miles regardless of which car she owns and would rent the same parking space. The sports car’s variable operating costs would be roughly the same as the variable operating costs of her old car. However, her insurance and automobile tax and licence costs would go up. What costs are relevant in estimating the incremental cost of owning the more expensive car? Explain.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen