Zuvetra Pharmaceuticals Ltd manufactures multivitamin medicines. In the past, Zuvetra has done very little in the way

Question:

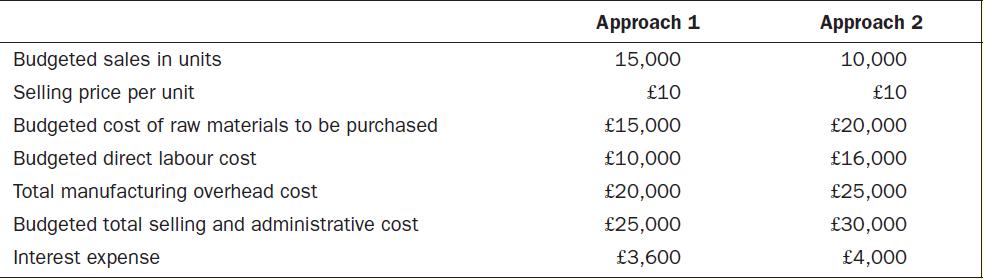

Zuvetra Pharmaceuticals Ltd manufactures multivitamin medicines. In the past, Zuvetra has done very little in the way of budgeting. The company has also faced cash crunches in previous years. Zuvetra’s top management has decided to bring in a full-fledged budgeting process from the current year. Zuvetra is planning to follow one of the following approaches:

Approach 1: A budget prepared based on the instructions provided by the top management on the profits or sales that are to be achieved

Approach 2: A budget prepared with the full assistance and participation of managers at all levels Zuvetra has prepared budgets using both approaches in the current year. Information regarding the budget for the year is given below:

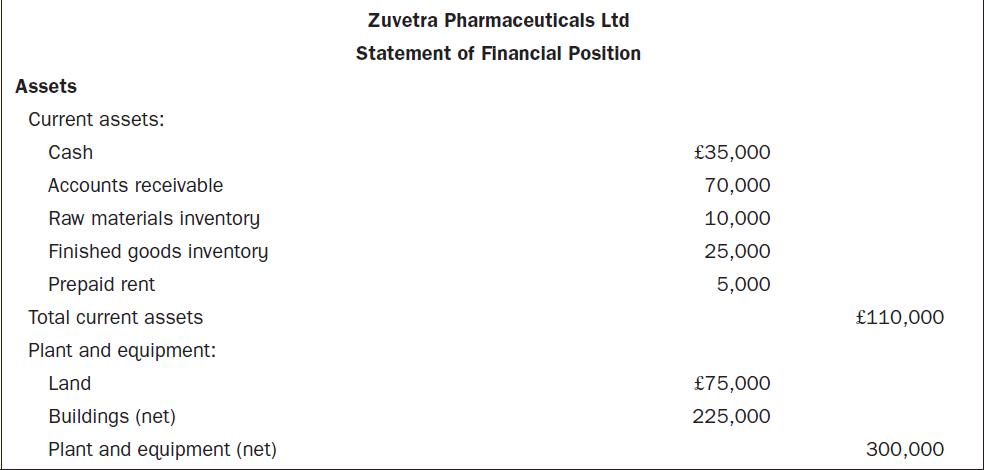

The statement of financial position of Zuvetra for the previous year is given below:

Zuvetra’s top management has determined the following information for the current year using the first approach of preparing budgets:

1. The budgeted cash balance at the end of the current year is expected to be £50,000.

2. During the year, the accounts receivable balance is expected to increase by 25% and the raw materials inventory and finished goods inventory are expected to increase by 20% each.

3. Prepaid rent is expected to remain constant.

4. Accounts payable and interest payable are expected to reduce by 15% each.

5. Common shares are expected to remain constant. The retained earnings are expected to increase to £162,400.

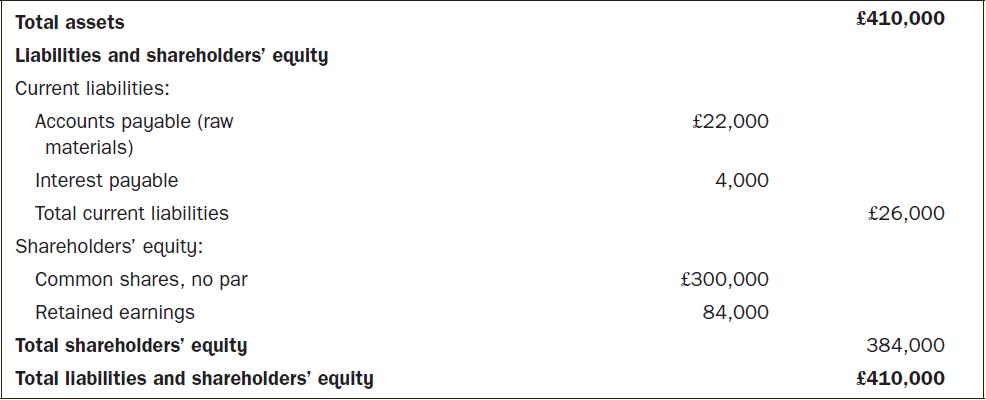

The company has determined the following information using the second approach of preparing budgets:

1. The budgeted cash balance at the end of the current year is expected to be £35,000.

2. During the year, the accounts receivable balance is expected to increase by 20% and the raw materials inventory and finished goods inventory are expected to increase by 10% each.

3. Prepaid rent is expected to remain constant.

4. Accounts payable and interest payable are expected to remain constant.

5. Common shares are expected to remain constant. The retained earnings are expected to increase to

£86,500.

6. The company is planning to raise long-term debt of £50,000.

Required

1. Prepare two budgeted statements of profit or loss for the current year using the amounts determined by Approach 1 and Approach 2, respectively.

2. Prepare two budgeted statements of financial position for the current year using the amounts determined by Approach 1 and Approach 2, respectively.

3. Describe a self-imposed budget and list the advantages of self-imposed budgets. Based on the values determined in the requirements above, describe which approach to preparing budgets is better.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen