Budenmayer BV is a small machine shop that uses highly skilled labour and a job-costing system (using

Question:

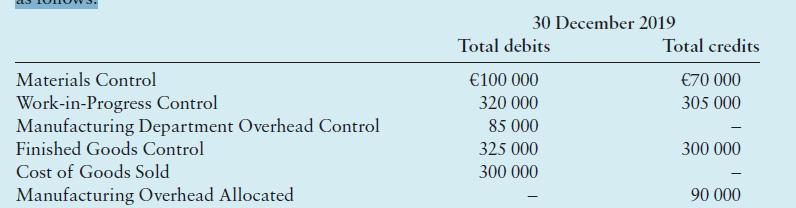

Budenmayer BV is a small machine shop that uses highly skilled labour and a job-costing system (using normal costing). The total debits and credits in certain accounts just before year-end are as follows:

All materials purchased are for direct materials. Note that ‘total debits’ in the stock accounts would include beginning stock balances, if any.

The preceding accounts do not include the following:

a. The manufacturing labour costs recapitulation for the 31 December working day: direct manufacturing labour, €5000 and indirect manufacturing labour, €1000.

b. Miscellaneous manufacturing overhead incurred on 30 December and 31 December: €1000.

Additional information

• Manufacturing overhead has been allocated as a percentage of direct manufacturing labour costs through 30 December.

• Direct materials purchased during 2019 were €85,000.

• There were no returns to suppliers.

• Direct manufacturing labour costs during 2019 totalled €150,000, not including the 31 December working day described previously.

Required

1. Calculate the stock (31 December 2018) of Materials Control, Work-in-Progress Control and Finished Goods Control. Show T-accounts.

2. Prepare all adjusting and closing journal entries for the preceding accounts. Assume that all under- or overallocated manufacturing overhead is closed directly to Cost of Goods Sold.

3. Calculate the ending stock (31 December 2019), after adjustments and closing, of Materials Control, Work-in-Progress Control and Finished Goods Control.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan