The management of Bay Company is considering a proposal to install a third production department within its

Question:

The management of Bay Company is considering a proposal to install a third production department within its existing factory building. With the company's present production setup, raw material is passed through Department I to produce Materials \(\mathrm{A}\) and \(\mathrm{B}\) in equal proportions. Material \(\mathrm{A}\) is then passed through Department II to yield Product C. Material B is presently being sold "as is" at a price of \(\$ 20.25\) per pound. Product \(C\) has a selling price of \(\$ 100\) per pound.

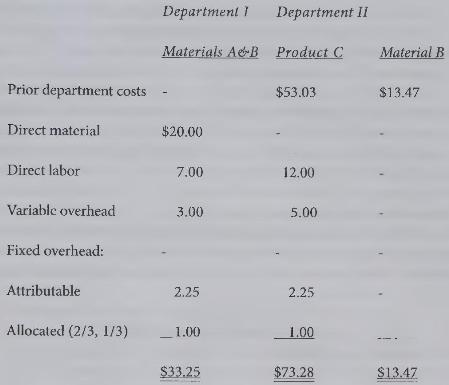

The per pound standard costs currently being used by the Bay Company are as follows:

These standard costs were developed by using an estimated production volume of 200,000 pounds of raw material as the standard volume. The company assigns Department I costs to Materials A and B in proportion to their net sales values at the point of separation, computed by deducting subsequent standard production costs from sales prices. The \(\$ 300,000\) of common fixed overhead costs are allocated to the two producing departments on the basis of the space used by the departments.

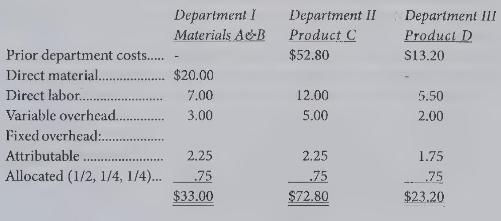

The proposed Department III would be used to process Material B into Product D. It is expected that any quantity of Product D can be sold for \(\$ 30\) per pound. Standard costs per pound under this proposal were developed by using 200,000 pounds of raw material as the standard volume and are as follows:

{Required:}

(a) If (1) sales and production levels are expected to remain constant in the foreseeable future, and (2) there are no foreseeable alternative uses for the available factory space, should the Bay Company install Department III and thereby produce Product D? Show calculations to support your answer.

(b) Instead of constant sales and production levels, suppose that under the present production setup \(\$ 1,000,000\) additions to the factory building must be made every 10 years to accommodate growth. Suppose also that proper maintenance gives these factory additions an infinite life and that all such maintenance costs are included in the standard costs which are set forth in the text of the problem. How would the analysis that you performed in Part A be changed if the installation of Department III shortened the interval at which the \(\$ 1,000,000\) factory additions are made from 10 years to 6 years? Be as specific as possible in your answer.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline