Managers at Eilert Corporation are analyzing a potential investment of $2,400,000 in equipment and the processes needed

Question:

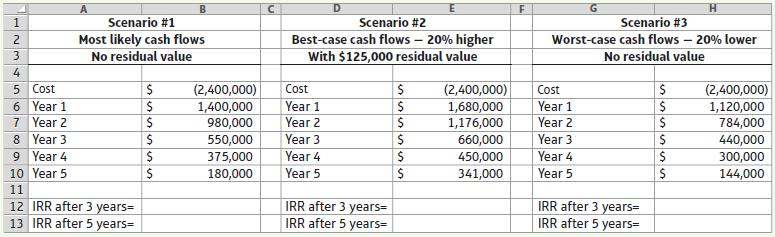

Managers at Eilert Corporation are analyzing a potential investment of $2,400,000 in equipment and the processes needed to manufacture and market HomeBotz, a product line of robots designed to assist elderly customers with daily tasks. Management feels that this equipment and project would be viable for a five-year period, although robot technology is rapidly evolving.

The sales manager, Frank McGonigal, calculated an internal rate of return (IRR) of 20.5% for the investment using the most likely cash flows for the project’s five-year life. McGonigal then recommended that Eilert make this investment in HomeBotz because it exceeds the Eilert capital investment hurdle rate of 16%.

The controller, Arlene Pittinger, countered with a sensitivity analysis using the IRR function in Excel that included three potential scenario outcomes.• Scenario 1: Most likely scenario. This scenario shows managers’ best estimate of the investment’s yearly net cash inflows and assumes no residual value.• Scenario 2: Best-case scenario. This scenario reflects cash flows that are 20% higher than the most likely scenario. It also assumes a $125,000 residual value at the end of Year 5. The residual value is already reflected in the cash inflow listed for Year 5.• Scenario 3: Worst-case scenario. This scenario reflects cash flows that are 20% lower than the most likely scenario, and assumes no residual value.

Requirements1. For each of the three scenarios, calculate thea. Internal rate of return (IRR) after three yearsb. Internal rate of return (IRR) after five years2. Look at your analysis in Requirement 1. Why would it be important to evaluate the IRR both at the end of three years and at the end of five years for this project?3. Based on your IRR calculations for Requirement 1 and your comments for Requirement 2, which plan would you recommend, and why?

Step by Step Answer: