Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that

Question:

Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that can be managed remotely using a smartphone app. The company has gathered the following data on probable costs and market potential:

a. New equipment would have to be acquired to produce the monitoring system. The equipment would cost $300,000 and be usable for 12 years. After 12 years, it would have a salvage value equal to 103 of the original cost.

b. Production and sales of the monitoring system would require a working capital investment of $120,000 to finance accounts receivable, inventories, and day-to-day cash needs. This working capital would be released for use elsewhere by the company after 12 years.

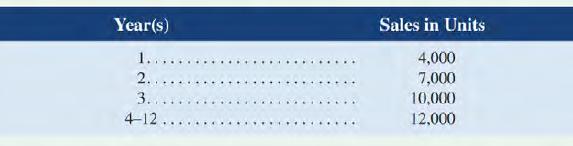

c. An extensive marketing study projects sales in units over the next 12 years as follows:

d. The monitoring systems would sell for $135 each; variable costs for production, administration, and sales would be $75 per unit.

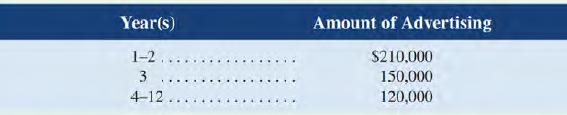

e. To gain entry into the market, the company would have to advertise heavily in the early years of sales. The advertising program follows:

f. Other fixed costs for salaries, insurance, maintenance, and straight-line depreciation on equipment would total $382,500 per year. (Depreciation is based on cost less salvage value.)

g. The company's required rate of return is 15%.

Required:

Ignore income taxes.

1. Compute the net cash inflow (cash receipts less yearly cash operating expenses) anticipated from sale of the monitoring systems for each year over the next 12 years.

2. Using the data computed in (I) above and other data provided in the problem, determine the net present value of the proposed investment. Would you recommend that Secure Homes invest in the new product?

3. What is the project's internal rate of return?

Step by Step Answer:

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby