Below is an excerpt from Bells Management Discussion and Analysis from its 10K for the year ended

Question:

Below is an excerpt from Bell’s Management Discussion and Analysis from its 10K for the year ended 12/31/2020:

Gross margin as a percentage of net revenue improved slightly to 19.1% during fiscal 2020, compared to 16.6% in fiscal 2019 and 15.9% in fiscal 2018. The year-over-year improvement in fiscal 2020 and 2019 was primarily driven by Bell’s continued cost-saving initiatives. During fiscal 2020, component costs continued to decline at a moderate pace that was relatively comparable to fiscal 2019. Management utilized these cost declines to balance profitable growth while passing on cost savings to its customers. Management expects the component cost environment to continue to be favorable during the first quarter of fiscal 2021. As part of management’s focus on improving margins, Bell remains committed to reducing costs through four primary costreduction initiatives: manufacturing costs, warranty costs, structural or design costs, and overhead or operating expenses.

Required

Compare your gross margin percentage calculations in Problem 14.8 to the statistics cited in the MD&A. Does the MD&A help you understand why the gross margin percentage changed between fiscal 2020 and fiscal 2019? In your own words (which may be much clearer than the verbiage in the MD&A), summarize what happened.

Data From Problem 14.8

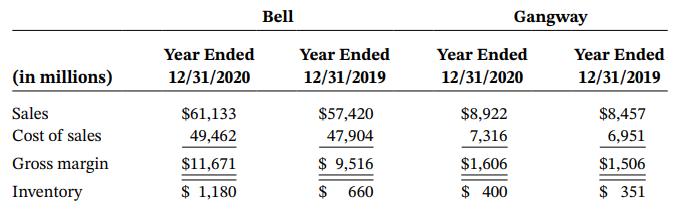

Financial information for Bell and Gangway (two computer manufacturers) follows:

Step by Step Answer: