M Ltd has two divisions, X and Y. Division X is a chip manufacturer and Division Y

Question:

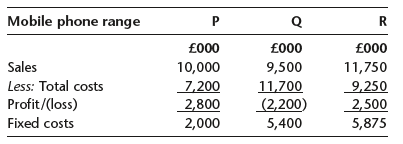

M Ltd has two divisions, X and Y. Division X is a chip manufacturer and Division Y assembles mobile phones. Division X currently manufactures many different types of chip, one of which is used in the manufacture of the mobile phones. Division X has no external market for the chips that are used in the mobile phones and currently sets the transfer price on the basis of total cost plus 20% mark-up. The budgeted profit and loss statement for Division Y for next year shows the following results:

The total costs shown above include the cost of the chips.Division Y uses a traditional absorption costing system based on labour hours.

M Ltd operates a performance measurement system based on divisional profits. In order to increase profit for the forthcoming year, Division Y has asked permission to buy chips from an external supplier. The accountant of M Ltd has recently attended a conference on activity-based costing (ABC) and has recommended that the divisions should implement an ABC system rather than continue to operate the traditional absorption costing system.

Required:a) A presenter at the conference stated that ‘ABC provides information that is more relevant for decision making than traditional forms of costing’. Discuss this statement, using Division Y when appropriate to explain the issues you raise. (8 marks)b) The management team of M Ltd has decided to implement ABC in all of the divisions. Discuss any difficulties which might be experienced when implementing ABC in the divisions. (6 marks)c) (i) Discuss the current transfer pricing system and explain alternative systems that might be more appropriate for the forthcoming year. (7 marks)(ii) Explain the impact that the introduction of an ABC system could have on the transfer price and on divisional profits. (4 marks) (Total 25 marks)

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor