The Summit Surfboard produces two surfboards. One is a recreational model made from polyurethane foam covered with

Question:

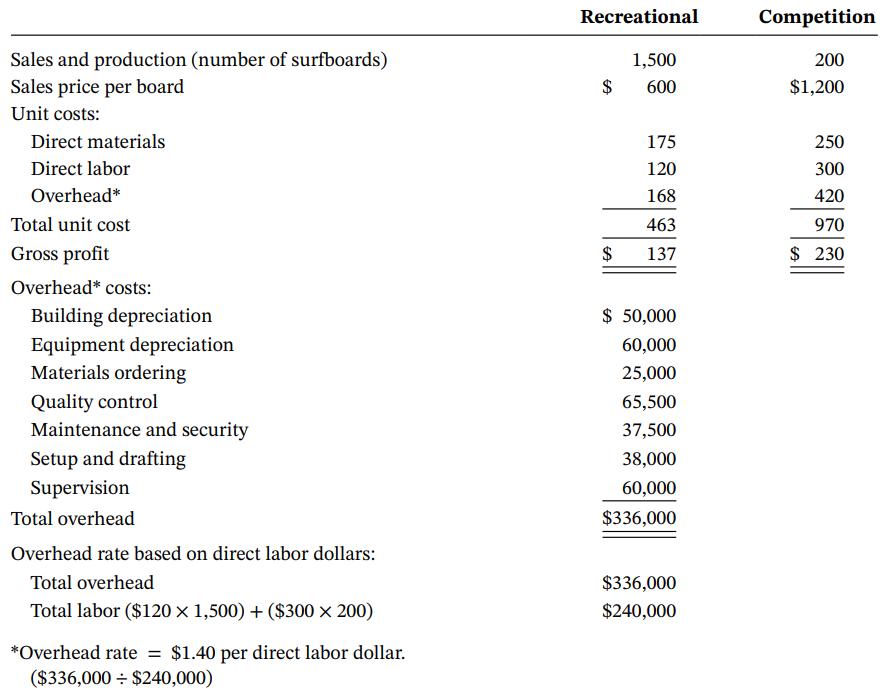

The Summit Surfboard produces two surfboards. One is a recreational model made from polyurethane foam covered with fiberglass cloth and epoxy resin. The other is a high performance competition board that uses carbon fiber instead of fiberglass. The carbon fiber boards are custom-made and require more hand finishing and setup time. Most of the company’s sales come from the recreational model, but recently sales of the competition boards have been increasing. The following information is related to the products for the most recent year:

Vikki Mason, the president of Summit, is concerned that the traditional cost system used by Summit may not be providing accurate cost information and that the sales price of the competition surfboard might not be enough to cover its true cost.

Required

a. The traditional system that Summit is using assigns 83 percent of the $336,000 total overhead to the recreational surfboard because 83 percent of the direct labor dollars are spent on the recreational surfboards. Discuss why this might not be an accurate way to assign overhead to surfboards.

b. Discuss how Summit might be able to improve cost allocation by using an ABC system.

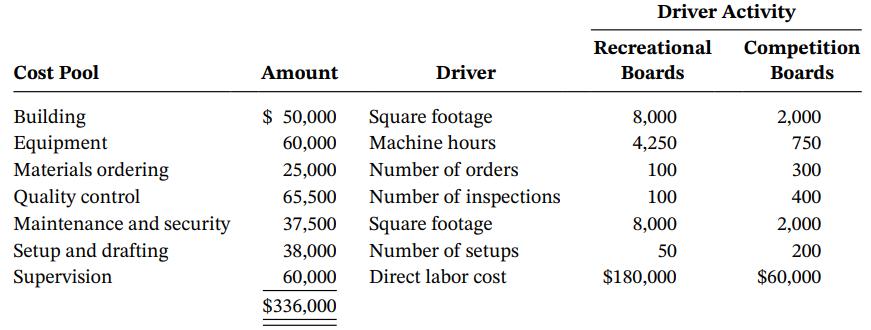

c. Assume that Summit retains a consultant to create an activity-based costing system, and the consultant develops the following data:

Determine the overhead allocation to each line of surfboards using an activity-based costing approach, and compute the total unit costs for each model surfboard. Round to two decimal places.

d. Discuss why activity-based allocations are different from those generated by the traditional allocation method used by Summit.

Step by Step Answer: