Assume that the amounts in Problem 4 are before taxes and the tax rate is 30%. As

Question:

Assume that the amounts in Problem 4 are before taxes and the tax rate is 30%. As a result, the analysis would differ as follows:

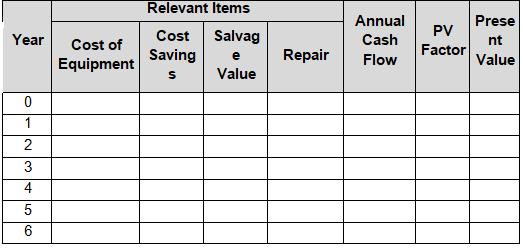

● The after-tax cash cost savings net only 70% of the amounts.

● The after-tax repair is only 70% of the value given.

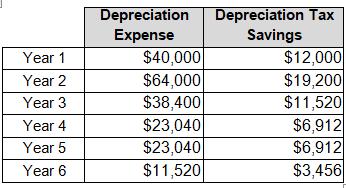

● The company uses accelerated depreciation to take greater depreciation deductions in the earlier years. The depreciation deductions and the 30% tax savings have already been calculated as follows:

● The after-tax salvage value is only 70% of the amount.

● The acquisition cost is not affected by taxes since it is a balance sheet account.

a. Set up the schedule of relevant cash flows below. Remember: Relevant items are those that differ between alternatives and occur in the future. Calculate the NPV in the last column.

b. Calculate the payback period assuming after-tax cash flows.

c. Should the company buy the equipment based on the quantitative analysis?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope