Grange Company has two departments. Stamping and Assembly. The company uses a job-order costing system and computes

Question:

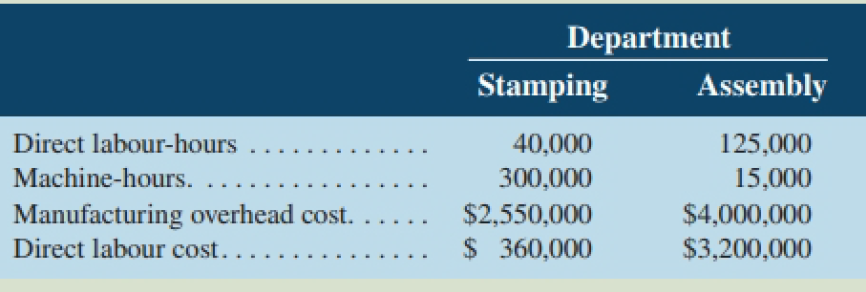

Grange Company has two departments. Stamping and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Stamping Department bases its rate on machine-hours, and the Assembly Department bases its rate on direct labour cost. At the beginning of the year, the company made the following estimates:

Required

1. Compute the predetermined overhead rate to be used in each department.

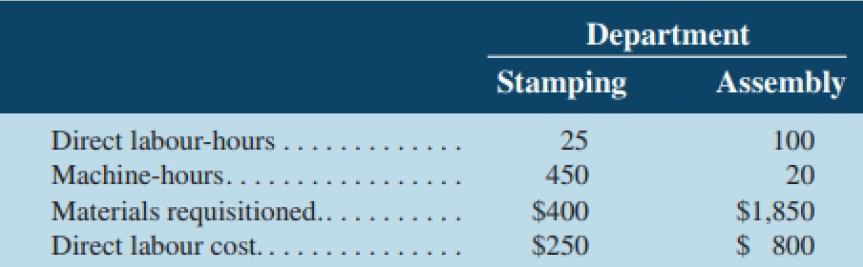

2. Assume that the overhead rates you computed in (I) above are in effect. The job cost sheet for Job 407, which was started and completed during the year, shows the following:

Compute the total overhead cost applied to Job 407.

3. Would you expect substantially different amounts of overhead cost to be charged to some jobs if the company used a plant wide overhead rate based on direct labour cost instead of using departmental rates? Explain. No computations are necessary.

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby