J. F. Outz, M.D., organized Hearts Inc. three years ago to practice cardiology. During April 20Y7, Hearts

Question:

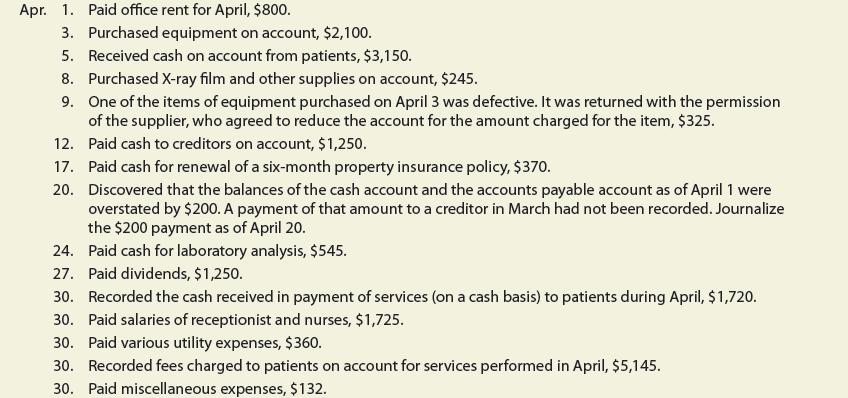

J. F. Outz, M.D., organized Hearts Inc. three years ago to practice cardiology. During April 20Y7, Hearts Inc. completed the following transactions: Hearts Inc.’s account titles, numbers, and balances as of April 1 (all normal balances) are listed as follows:

Hearts Inc.’s account titles, numbers, and balances as of April 1 (all normal balances) are listed as follows:

Cash, 11, $4,123; Accounts Receivable, 12, $6,725; Supplies, 13, $290; Prepaid Insurance, 14, $465; Equipment, 18, $19,745; Accounts Payable, 22, $765; Common Stock, 31, $10,000; Retained Earnings, 32, $20,583; Dividends, 33, $0; Professional Fees, 41, $0; Salary Expense, 51, $0; Rent Expense, 53, $0; Laboratory Expense, 55, $0; Utilities Expense, 56, $0; Miscellaneous Expense, 59, $0.

Instructions

1. Open a ledger of standard four-column accounts for Hearts Inc. as of April 1. Enter the balances in the appropriate balance columns and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.)

2. Journalize each transaction in a two-column journal.

3. Post the journal to the ledger, extending the month-end balances to the appropriate balance columns after each posting.

4. Prepare an unadjusted trial balance as of April 30.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9781337902663

15th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William B. Tayler