Simple Company uses a traditional volume-based costing system with a single overhead cost pool and direct labor

Question:

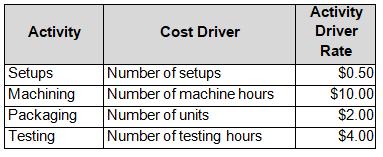

Simple Company uses a traditional volume-based costing system with a single overhead cost pool and direct labor hours as the cost driver. Simple estimates total overhead for the year at $76,200 and total direct labor hours of 10,000. The company has conducted an ABC analysis with the following data:

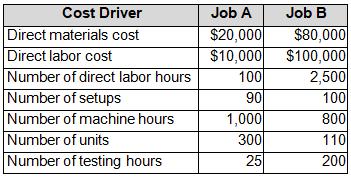

The two jobs processed in the month of June had the following characteristics:

a. What is Simple Company’s single overhead cost driver rate if the company allocates all overhead based on direct labor hours?

b. Compute for Simple Company the unit manufacturing costs of each job under the traditional costing system, whereby all overhead costs are assigned based on direct labor hours.

c. Compute for Simple Company the unit manufacturing costs of each job under the ABC system.

d. Compare Simple Company’s unit manufacturing costs for Jobs A and B when the overhead costs are assigned based on ABC and when the overhead costs are assigned based on direct labor hours.

e. Why do the two cost systems differ on the total cost for each job?

f. Do you believe that some of the overhead costs could be directly captured for each job using technology? Discuss.

g. For which strategic and operational control decisions might these differences be important?

h. How would you present this information to management to make it useful?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope