For a Heston model, take mean reversion of 15%. Calibrate , , (t) to the prices

Question:

For a Heston model, take mean reversion of 15%. Calibrate η, ρ, θ (t) to the prices of strangles and risk reversals over 5 years (using the characteristic function method for pricing European options in Section 6.3.3.). What does the implied vol smile look like for 5 years versus 1 month? Repeat this for mean reversion of 200 %.

Section 6.3.3.

Transcribed Image Text:

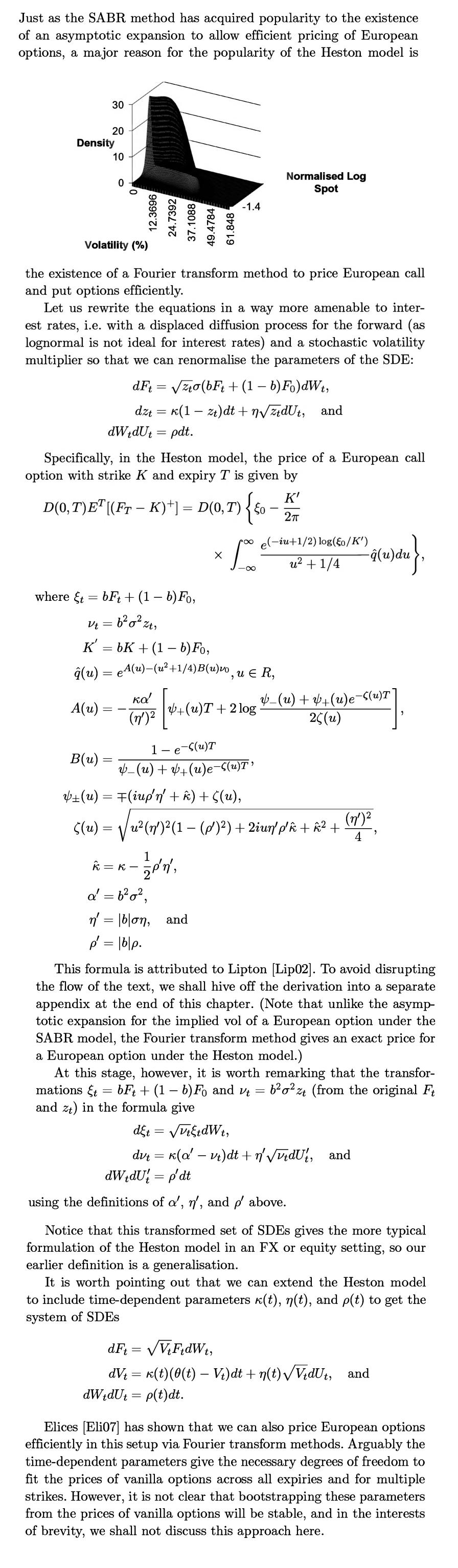

Just as the SABR method has acquired popularity to the existence of an asymptotic expansion to allow efficient pricing of European options, a major reason for the popularity of the Heston model is Density 30 20 Volatility (%) 10 Vt = 0 the existence of a Fourier transform method to price European call and put options efficiently. A(u) = = B(u) Let us rewrite the equations in a way more amenable to inter- est rates, i.e. with a displaced diffusion process for the forward (as lognormal is not ideal for interest rates) and a stochastic volatility multiplier so that we can renormalise the parameters of the SDE: 12.3696 24.7392 37.1088 where t = bFt+ (1 -b) Fo, = 6 6 %t, dFt = zto(bFt + (1 - b) Fo)dWt, dzt = k(1zt)dt +nzdUt, and dWtdUt = pdt. Specifically, in the Heston model, the price of a European call option with strike K and expiry T is given by K' D(0, T)ET [(FT K)+] = D(0, T) 0, T) { $0 - 2T = - 49.4784 61.848 K' =bK + (1 - b) Fo, (u) = A(u)(u+1/4)B(u)vo, u R, +(u)T + 2log (n') K= K - -1.4 1 a = b0, n = |b|on, and p' = |b|p. Normalised Log Spot X 1 -s(u)T v_(u) + +(u)e-S(u)T p'n', = (u) = F(iup'n' + k) + ((u), 5(u) = /u(n)(1 (P)) + 2iun/p/k+k + roo e(-iu+1/2) log(o/K') u + 1/4 fo - (u) du v_(u) + +(u)e-s(u)T 25(u) (n') This formula is attributed to Lipton [Lip02]. To avoid disrupting the flow of the text, we shall hive off the derivation into a separate appendix at the end of this chapter. (Note that unlike the asymp- totic expansion for the implied vol of a European option under the SABR model, the Fourier transform method gives an exact price for a European option under the Heston model.) At this stage, however, it is worth remarking that the transfor- mations Et bFt + (1 - b) Fo and vt bo2t (from the original F and zt) in the formula give = det = ttdWt, dvt= k(a' - vt)dt +n'd, and }, dWtdU!= p'dt using the definitions of a', n', and p' above. Notice that this transformed set of SDEs gives the more typical formulation of the Heston model in an FX or equity setting, so our earlier definition is a generalisation. It is worth pointing out that we can extend the Heston model to include time-dependent parameters (t), n(t), and p(t) to get the system of SDES dFt = V+FtdWt, dVt = k(t)(0(t) Vt)dt + n(t)tdUt, and dWtdUt p(t)dt. Elices [Eli07] has shown that we can also price European options efficiently in this setup via Fourier transform methods. Arguably the time-dependent parameters give the necessary degrees of freedom to fit the prices of vanilla options across all expiries and for multiple strikes. However, it is not clear that bootstrapping these parameters from the prices of vanilla options will be stable, and in the interests of brevity, we shall not discuss this approach here.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Mamba Dedan

I am a computer scientist specializing in database management, OS, networking, and software development. I have a knack for database work, Operating systems, networking, and programming, I can give you the best solution on this without any hesitation. I have a knack in software development with key skills in UML diagrams, storyboarding, code development, software testing and implementation on several platforms.

4.90+

67+ Reviews

156+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes on either side of the forward. Using the approximation to the SABR formula per Section 6.2.3,...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

A car is randomly selected at a traffic safety checkpoint, and the car has 6 cylinders. Determine whether the given values are from a discrete or continuous data set.

-

A 120-mm-diameter hole is cut as shown in a thin disk of 600-mm diameter. The disk rotates in a horizontal plane about its geometric center A at the constant rate of 480 rpm. Knowing that the disk...

-

Solve the quadratic equation by factoring. 1. 6x2 + 3x = 0 2. 8x2 2x = 0 3. 3 + 5x 2x2 = 0

-

A 6061-T6 aluminum alloy solid circular rod of length \(4 \mathrm{~m}\) is pinned at both of its ends. If it is subjected to an axial load of \(15 \mathrm{kN}\) and F.S. \(=2\) against buckling,...

-

Fidelity Audio Inc. manufactures electronic stereo equipment. The manufacturing process includes printed circuit (PC) board assembly, final assembly, testing, and shipping. In the PC board assembly...

-

1. If a 3 3 matrix A has det(A) = 1, find det (A), det(-A), det(A), and det(A).

-

Consider the Taylor expansion of the integrand of the cumulative normal function for x 0, i.e. Thereby, find an approximation for the price of a lognormal option close-to-the-money. Attempt...

-

Consider a lognormal Libor Market Model. For simplicity, assume that Libor rates apply over 1y periods. Take current Libor rates to be flat at 3%. Using the discussion on the volatility triangle in...

-

Explain a surgical team as a kind of functional group. What features does it share with most functional groups? What features distinguish it from most functional groups?

-

QUESTION TWO (20 MARKS) Consider a discrete random variable taking values 0, 1, 2, 3,... Find E(T) as a function of the survivor function. Hence find the mean of the random variable whose survivor...

-

QUESTION 5 (20 MARKS) The following is a report of a clinical trial to evaluate the efficiency of maintenance Chemotherapy for acute Leukemia. Patients were randomly allocated to group 1 and II....

-

Solve the predator prey model developed in (a) above and use the solution to show that in the absence of the predators, the prey grows exponentially and in the absence of the prey the predator...

-

and 10 B=0,+r cosa,+a, in cartesian and cylindrical coordinates Express the vector and find B=(-3,4,0) Two blocks of masses 10kg and 20kg are placed on the x-axis. The first mass is moved on the axis...

-

Using the Black-Scholes option pricing model, determine the following: a) the value of the call option; b) value of the put option. What is the value of the put option using the put-call parity?...

-

The handle of a jackscrew is 60.0 cm long. (a) If the mechanical advantage is 78.0, what is the pitch? (b) How much weight can be raised by applying a force of 430 N to the jackscrew handle?

-

The purpose of this case is to come up with a contingency plan[s] in order to sustain the program Move With Me, a program that serves thousands of community members throughout Lower Manhattan. The...

-

Propose a plausible synthesis for the following transformation, in which the carbon skeleton is increased by only one carbon atom: H.

-

Methylene chloride (CH 2 Cl 2 ) has fewer chlorine atoms than chloroform (CHCl 3 ). Nevertheless, methylene chloride has a larger molecular dipole moment than chloroform. Explain.

-

Write an equation for the proton transfer reaction that occurs when each of the following acids reacts with water. In each case, draw curved arrows that show the mechanism of the proton transfer: (a)...

-

The following balances are from the beginning of the year for Dezie Company as of December 31, 20X0: Cash Accounts Receivable 125,000 40,000 Allowance for Doubtful Accts 2,000 Inventory 45,000 (5...

-

Look at the futures listings for the corn contract in Table 2.8. Suppose you buy one contract for Sep-16 delivery. If the contract closes in Sep-16 at a level of 3.86, what will your profit be? (Do...

-

Radar Company sells bikes for $500 each. The company currently sells 4,350 bikes per year and could make as many as 4,740 bikes per year. The bikes cost $270 each to make: $180 in variable costs per...

Study smarter with the SolutionInn App