Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes

Question:

Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes on either side of the forward. Using the approximation to the SABR formula per Section 6.2.3, compute the implied vols for strikes 0.8 F, F, and 1.25F : where F = 1 is the initial value of the forward. Take σ0 = 15%, β = 1, ρ = −30%, and ν = 50% initially. Try varying each of σ0, ρ, and ν one at a time and see how the smile changes. Hence, convince yourself that a mapping between σ0, ρ, ν, and atm option prices, risk reversal prices, strangle prices is meaningful and stable.

Section 2.3.2

Section 6.2.3

Transcribed Image Text:

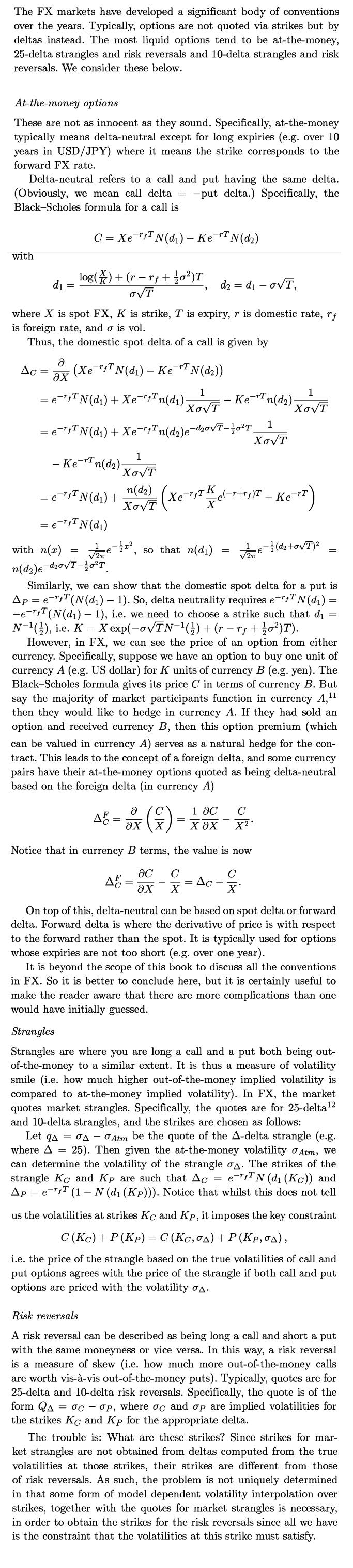

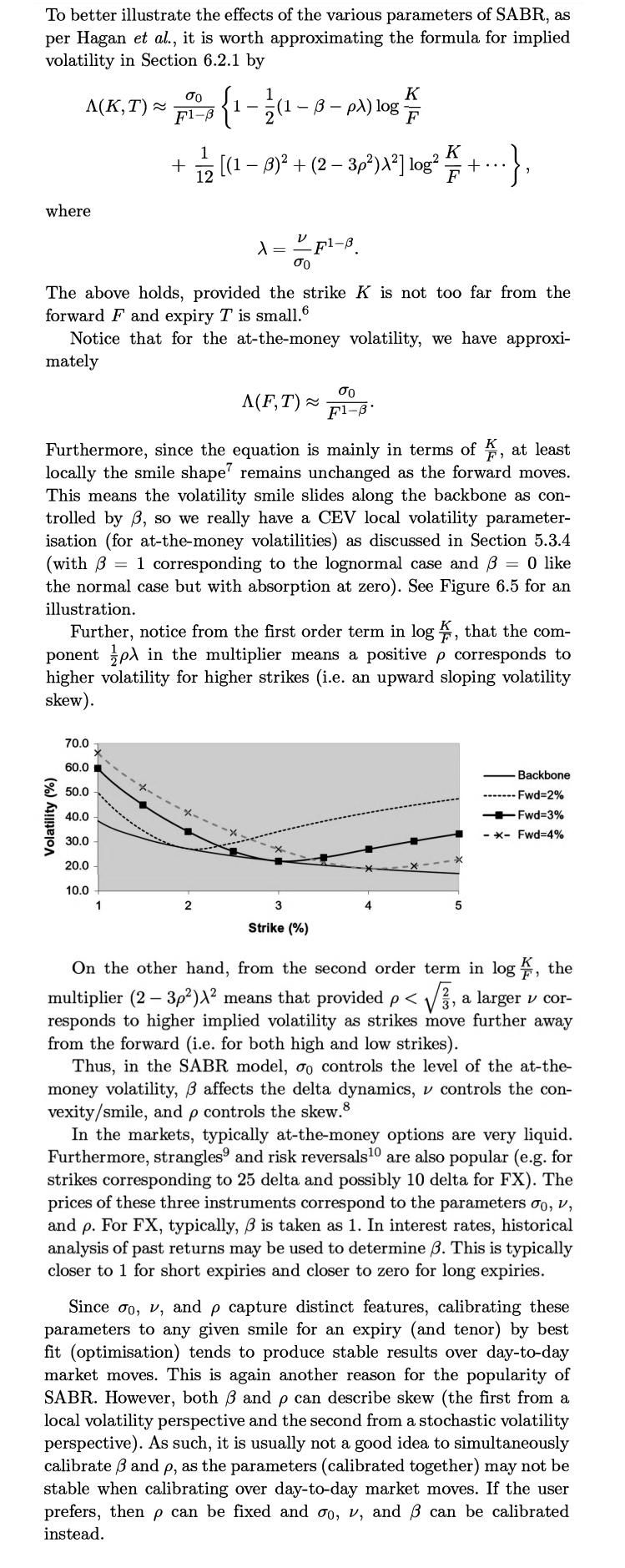

The FX markets have developed a significant body of conventions over the years. Typically, options are not quoted via strikes but by deltas instead. The most liquid options tend to be at-the-money, 25-delta strangles and risk reversals and 10-delta strangles and risk reversals. We consider these below. At-the-money options These are not as innocent as they sound. Specifically, at-the-money typically means delta-neutral except for long expiries (e.g. over 10 years in USD/JPY) where it means the strike corresponds to the forward FX rate. Delta-neutral refers to a call and put having the same delta. (Obviously, we mean call delta = put delta.) Specifically, the Black-Scholes formula for a call is C =Xe"fTN(dı) — KenTN(d2) with d₁ Ac d₂=d₁ - o√T, where X is spot FX, K is strike, T is expiry, r is domestic rate, rf is foreign rate, and o is vol. Thus, the domestic spot delta of a call is given by log()+ (r-rf + 1/0²) T αντ > = Ə (XefT TN(d₁) - Ke TN (dz)) Əx 1 =enf7 N(d1) + Xe-"Tn(d1) -Ke-T 'n(d₂). 'Χοντ =e="fT N(d₁) + Xe-¹₁Tn(d₂)e-d₂0√T-10²T_ - Ke-Tn(d₂). with n(x) n(d₂)e = e¯¹₁¹ N(d₁) + = e-rf™ N(d₁) = -d₂0√T-10²T e 1 Χοντ ², so that n(d₁) A n(d₂) {e(_r+r₁) XOVE (Xe - IT Kel-T+7)T - KerT) Χοντ X 48= 2x (x)=xax-X² 1 = Similarly, we can show that the domestic spot delta for a put is Ap = efT (N(d₁) 1). So, delta neutrality requires e −fTN(d1)= -e-T (N(d₁) 1), i.e. we need to choose a strike such that d₁ N-¹ (), i.e. K = X exp(-o√/TN−¹(½) + (r − rƒ + 1/0²)T). However, in FX, we can see the price of an option from either currency. Specifically, suppose we have an option to buy one unit of currency A (e.g. US dollar) for K units of currency B (e.g. yen). The Black-Scholes formula gives its price C in terms of currency B. But say the majority of market participants function in currency A,¹ then they would like to hedge in currency A. If they had sold an option and received currency B, then this option premium (which can be valued in currency A) serves as a natural hedge for the con- tract. This leads to the concept of a foreign delta, and some currency pairs have their at-the-money options quoted as being delta-neutral based on the foreign delta (in currency A) = Notice that in currency B terms, the value is now ac C C əx X X = Ac 1 Χοντ √ (d₂+0√T) ² e √2π 1 Χσντ C On top of this, delta-neutral can be based on spot delta or forward delta. Forward delta is where the derivative of price is with respect to the forward rather than the spot. It is typically used for options whose expiries are not too short (e.g. over one year). It is beyond the scope of this book to discuss all the conventions in FX. So it is better to conclude here, but it is certainly useful to make the reader aware that there are more complications than one would have initially guessed. Strangles Strangles are where you are long a call and a put both being out- of-the-money to a similar extent. It is thus a measure of volatility smile (i.e. how much higher out-of-the-money implied volatility is compared to at-the-money implied volatility). In FX, the market quotes market strangles. Specifically, the quotes are for 25-delta¹² and 10-delta strangles, and the strikes are chosen as follows: Let q = σA Atm be the quote of the A-delta strangle (e.g. where A = 25). Then given the at-the-money volatility Atm, we can determine the volatility of the strangle A. The strikes of the strangle K and Kp are such that Ac = efTN (d₁ (Kc)) and Ape TT (1- N (di (Kp))). Notice that whilst this does not tell us the volatilities at strikes Kc and Kp, it imposes the key constraint C (Kc) + P (Kp) C (Kc,σA) + P (Kp,σA), i.e. the price of the strangle based on the true volatilities of call and put options agrees with the price of the strangle if both call and put options are priced with the volatility σ. Risk reversals A risk reversal can be described as being long a call and short a put with the same moneyness or vice versa. In this way, a risk reversal is a measure of skew (i.e. how much more out-of-the-money calls are worth vis-à-vis out-of-the-money puts). Typically, quotes are for 25-delta and 10-delta risk reversals. Specifically, the quote is of the form QA = oc-op, where ac and op are implied volatilities for the strikes Ke and Kp for the appropriate delta. The trouble is: What are these strikes? Since strikes for mar- ket strangles are not obtained from deltas computed from the true volatilities at those strikes, their strikes are different from those of risk reversals. As such, the problem is not uniquely determined in that some form of model dependent volatility interpolation over strikes, together with the quotes for market strangles is necessary, in order to obtain the strikes for the risk reversals since all we have is the constraint that the volatilities at this strike must satisfy.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Hamza Amjad

Currently I am student in master degree program.from last two year I am tutring in Academy and I tought many O/A level student in home tution.

4.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The demand for a commodity typically depends on the income of the consumer, the real price of the commodity, and the real price of complementary or competing products. Table P-20 gives the per capita...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Write a program that takes an integer command-line argument n and prints all the positive powers of 2 less than or equal to n. Make sure that your program works properly for all values of n.

-

Explain sustainable income. What relationship does this concept have to the treatment of irregular itemson the income statement?

-

Find the first derivatives. f(t) = (t 2 + 1) 5

-

(a) A brick slides more easily on ice than on wood. For which combination (brick on ice or brick on wood) is \(\mu_{s}\) larger? (b) For rubber on dry asphalt, \(\mu_{s}\) is about 1 . Ignoring any...

-

Figure 4-36 includes an EER diagram describing a car racing league. Transform the diagram into a relational schema that shows referential integrity constraints (see Figure 4-5 for an example of such...

-

Operating systems and application programs play vital role in our daily usage of computers. Differentiate between an operating system and an application program give examples each.

-

Take the actual SABR formula per Section 6.2.1 with 0 = 0.5%, = 0, = 25%, = 30%, and F = 4%. By considering an expiry of 20 years and strikes at 10 basis points increments from 1 % to 2 %...

-

Consider the Hull-White model with SDE dr t = ,(t)((t) r t )dt + (t)dW t . Following the same logic as we did in the text, determine (t). Can you see why in practice calculating (t) directly is not...

-

Decide whether each relation defines a function, and give the domain and range. x.......................... y 0.......................... 0 1......................... -1 2......................... -2

-

On 1 July 20x3, Small Ltd issued 10 million new shares to owners of Sumo Pte Ltd in exchange for all of Sumo Pte Ltds shares. The share exchange is the result of a reverse acquisition of Small Ltd by...

-

On 1 January 20x1, P Co entered into an agreement with Tuscany Co to acquire the net assets and business of Tuscany Co. The following transactions arose on 1 July 20x1 to execute the agreement with...

-

Superior Corporations summary statement of financial position as at 31 December 20x2 is as follows. Additional information (a) Non-current liability was made up solely of a $10,000,000 convertible...

-

The following graph shows inflation and unemployment rates for Canada for the period between 1970 and 2012. Does this graph show evidence in favor of the Phillips curve? 14 12 10 8 6 4 1 O 2 Canada...

-

Assuming that Okuns law is given by U U n = 0.75 (Y Y P ) and that the Phillips curve is given by = e - 0.6 (U U n ) + , a) Obtain the short-run aggregate supply curve if expectations are...

-

Hurst, Incorporated sold its 8% bonds with a maturity value of $3,000,000 on August 1, 2009 for $2,946,000. At the time of the sale, the bonds had five years until they reached maturity. Interest on...

-

A sprinkler head malfunctions at midfield in an NFL football field. The puddle of water forms a circular pattern around the sprinkler head with a radius in yards that grows as a function of time, in...

-

Identify the reagents you would use to convert 2-bromo-2-methylbutane into 3-methyl-1-butyne.

-

Would ethanol (CH 3 CH 2 OH) be a suitable solvent in which to perform the following proton transfer? Explain your answer: ONH2 + NH3 NH2 H.

-

Identify the reagents you would use to convert 1-pentene into a geminal dibromide (geminal indicates that both bromine atoms are connected to the same carbon atom).

-

Apple issues dividend every quarter (see more information below). (a) The close prices on August 6, 2021 and May 6, 2022 is $146.14 and $157.28. What is Apple's stock return? And what is the growth...

-

Drone Berhad wants to do a stock split of 5 to 1. Given below is the partial equity account for Drone Berhad: Partial Equity Account for Drone Berhad (RM) Common Stock @ RM2 Premium Retained Earnings...

-

Update Knowledge of the Events Industry. ASSESSMENT INSTRUCTIONS While being observed by your assessor, you are to use information identified and opportunities to update knowledge of the events...

Study smarter with the SolutionInn App