Consider a European down-and-out call option where the terminal payoff depends on the payoff state variable S

Question:

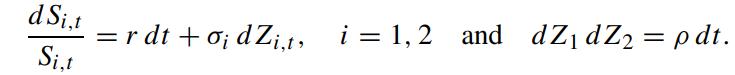

Consider a European down-and-out call option where the terminal payoff depends on the payoff state variable S1 and knock-out occurs when the barrier state variable S2 breaches the downstream barrier B2. Assume that under the risk neutral measure Q, the dynamics of S1,t and S2,t are given by

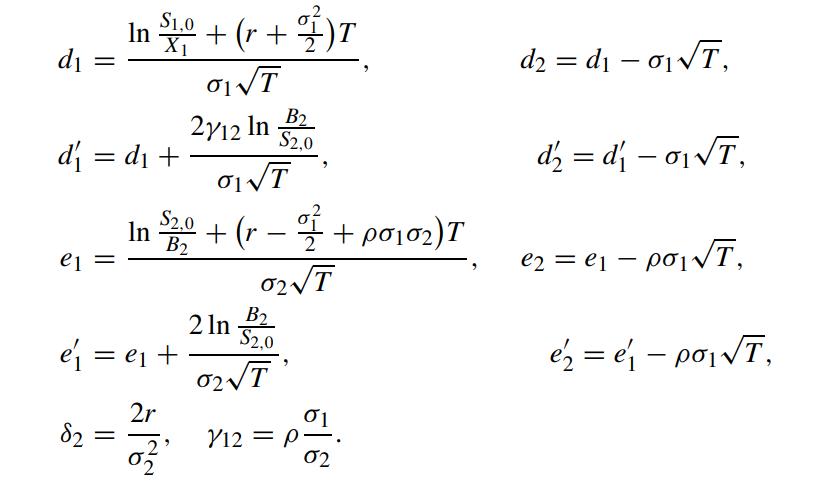

Let X1 denote the option’s strike price. Show that the price of this down-andout call with an external barrier is given by (Kwok, Wu and Yu, 1998)

Let X1 denote the option’s strike price. Show that the price of this down-andout call with an external barrier is given by (Kwok, Wu and Yu, 1998)

![call price = erTEQ[(S1,7 X)1(Sr>X(m>B]] 82-1+2/12 B2 - 5.0 [N2(d, 42; p) - (2)-1 = $2.0 N, 41;P)] N( er X[N](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/2/447655b4d8f3fb521700482443513.jpg)

where

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: