Consider a self-financing portfolio that contains t units of the underlying risky asset whose price process

Question:

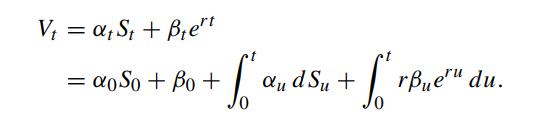

Consider a self-financing portfolio that contains αt units of the underlying risky asset whose price process is St and βt dollars of the money market account with riskless interest rate r. Suppose the initial portfolio contains α0 units of the risky asset and β0 dollars of money market account. Show that the time-t value of the portfolio value Vt is given by

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: