Consider an American call option with the callable feature, where the issuer has the right to recall

Question:

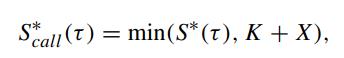

Consider an American call option with the callable feature, where the issuer has the right to recall throughout the whole life of the option. Upon recall by the issuer, the holder of the American option can choose either to exercise his option or receive the constant cash amount K. Let S∗call(τ) and S∗(τ) denote the optimal exercise boundary of the callable American call and its noncallable counterpart, respectively. Show that

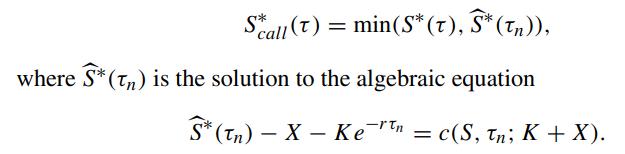

where X is the strike price. Furthermore, suppose the holder is given a notice period of length τn, where his or her decision to exercise the option or receive the cash amount K is made at the end of the notice period. Show that the optimal exercise boundary S∗call(τ) now becomes

Here, c(S,τn; K + X) is the price of the European option with time to expiry τn and strike price K + X (Kwok and Wu, 2000; Dai and Kwok, 2005b).

Note that S∗call (τ) cannot be greater than K + X. If otherwise, at asset price level satisfying K + X ∗ call(τ), the intrinsic value of the American call is above K. This represents a nonoptimal recall policy of the issuer.

Step by Step Answer: