Unlike usual option contracts, the holder of an installment option pays the option premium throughout the life

Question:

Unlike usual option contracts, the holder of an installment option pays the option premium throughout the life of the option. The installment option is terminated if the holder chooses to discontinue the installment payment. In normal cases, the installments are paid at predetermined time instants within the option’s life. In this problem, we consider the two separate cases: continuous payment stream and discrete payments.

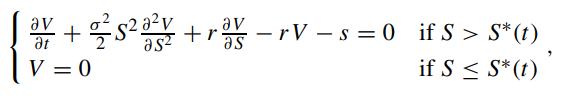

First, we let s denote the continuous rate of installment payment so that the amount sΔt is paid over the interval Δt. Let V (S,t) denote the value of a European installment call option. Show that V (S,t) is governed by

where S∗(t) is the critical asset price at which the holder discontinues the installment payment optimally. Solve for the analytic price formula when the installment option has infinite time to expiration (perpetual installment option).

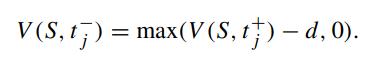

Next, suppose that installments of equal amount d are paid at discrete instants tj ,j = 1, ··· ,n. Explain the validity of the following jump condition across the payment date tj.

Finally, give a sketch of the variation of the option value V (S,t) as a function of the calendar time t at varying values of asset value S under discrete installment payments.

Finally, give a sketch of the variation of the option value V (S,t) as a function of the calendar time t at varying values of asset value S under discrete installment payments.

There is an increase in the option value of amount d right after the installment payment. Also, it is optimal not to pay the installment at time tj if V (S,t+j) ≤ d.

Step by Step Answer: