Let p(S, t; t) denote the value of a floating strike lookback put option with discrete monitoring

Question:

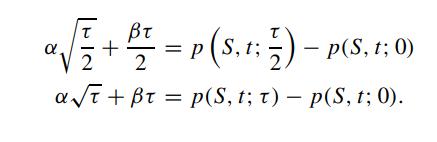

Let p(S, t; δt) denote the value of a floating strike lookback put option with discrete monitoring of the realized maximum value of the asset price, where δt is the regular interval between monitoring instants. Suppose we assume the following two-term Taylor expansion of p(S, t; δt) in powers of √δt (Levy and Mantion, 1997)

![]()

With δt = 0, p(S,t; 0) represents the floating strike lookback put value corresponding to continuous monitoring. Let τ denote the time to expiry. By setting δt = τ and δt = τ/2, we deduce the following pair of linear equations for α and β:

Hence, p(S,t; τ) is simply the vanilla put value with strike price equal to the current realized maximum asset price M. With only one monitoring instant at the midpoint of the remaining option’s life, show that p(S,t; τ/2 ) is given by

![= where p(S,t; 7) -e-q S + et e **[ MN2 ( _dm ( 1 ) + 0 ] - dm(t) + o : ; = /12) + er-9) SN dm (T), d 12](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/7/290655b607a3e4131700487280313.jpg)

Once α and β are determined, we then obtain an approximate price formula of the discretely monitored floating strike lookback put.

Step by Step Answer: