Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price x

Question:

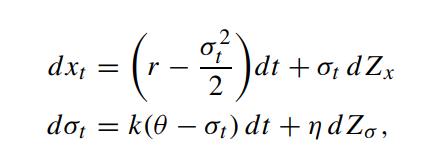

Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price xt = ln St and its instantaneous volatility σt are assumed to be governed by

where dZx dZσ = ρdt. All model parameters are taken to be constant. The price function of a European call option with strike price X and maturity date T takes the form

![where Fj c(St, ot, t; T) = S F e-r(T-1) X Fo, F-+Re()do. fj (0) e-ix JO fo(0) Elexp(ixT)], fi(0) = E[exp(-r](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/1/312655b4920723691700481305869.jpg)

Solve for f0(∅) and f1(∅) (Schöbel and Zhu, 1999).

Transcribed Image Text:

(r-2/2² ) dt + dot = k(0o₁) dt+nd Zo, dxt = dt + ot dZx

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

The equations provided seem to involve a stochastic differential equation SDE describing the dynamic...View the full answer

Answered By

Saikumar Ramagiri

Financial accounting:- Journal and ledgers, preparation of trail balance and adjusted trail balance Preparation of income statement, retained earning statement and balance sheet Banks reconciliation statements Financial statement analysis Cash flow statement analysis (both direct and indirect methods) All methods of Depreciations Management Accounting:- Ratios Budgeting control Cash budget and production budget Working capital management Receivable management Costing:- Standard and variance costing Marginal costing and decision making Cost-volume-profit analysis Inventory management (LIFO, FIFO) Preparation and estimation of cost sheet Portfolio management:- Calculation of portfolio standard deviation or risk Calculation of portfolio expected returns CAPM, Beta Financial management:- Time value of money Capital budgeting Cost of capital Leverage analysis and capital structure policies Dividend policy Bond value calculations like YTM, current yield etc International finance:- Derivatives Futures and options Swaps and forwards Business problems Finance problems Education (mention all your degrees, year awarded, Institute/University, field(s) of major): Education Qualification Board/Institution/ University Month/Year of Passing % Secured OPTIONALS/ Major ICWAI(inter) ICWAI inter Pursuing Pursuing - M.com(Finance) Osmania University June 2007 65 Finance & Taxation M B A (Finance) Osmania University Dec 2004 66 Finance & Marketing. B.Com Osmania University June 2002 72 Income Tax, Cost & Mgt, Accountancy, Auditing. Intermediate (XII) Board of Intermediate May 1999 58 Mathematics, Accountancy, Economics. S S C (X) S S C Board. May 1997 74 Mathematics, Social Studies, Science. Tutoring experience: • 10 year experience in online trouble shooting problems related to finance/accountancy. • Since 6 Years working with solution inn as a tutor, I have solved thousands of questions, quick and accuracy Skills (optional): Technical Exposure: MS Office, SQL, Tally, Wings, Focus, Programming with C Financial : Portfolio/Financial Management, Ratio Analysis, Capital Budgeting Stock Valuation & Dividend Policy, Bond Valuations Individual Skills : Proactive Nature, Self Motivative, Clear thought process, Quick problem solving skills, flexible to complex situations. Achievements : 1. I have received an Award certificate from Local Area MLA for the cause of getting 100% marks in Accountancy during my Graduation. 2. I have received a GOLD MEDAL/Scholarship from Home Minister in my MBA for being the “Top Rank student “ of management institute. 3. I received numerous complements and extra pay from various students for trouble shooting their online problems. Other interests/Hobbies (optional): ? Web Surfing ? Sports ? Watching Comics, News channels ? Miniature Collection ? Exploring hidden facts ? Solving riddles and puzzles

4.80+

391+ Reviews

552+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The price function of a European call option under stochastic interest rates can also be solved using the partial differential equation approach. Let the asset value process S t and the short rate...

-

3. The sketch shows an exploded drawing of a pump driven by a 1.5-kW, 1800-rpm motor integrally attached to a 4:1 ratio gear reducer. Reducer shaft C is connected directly to pump shaft C' through a...

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

Football Comm LLC is a manufacturer of devices for football coaches and their coaching staffs that enable them to quickly and effectively communicate with one another during a game through a wireless...

-

How should rainy day funds be reported under GASB Statement 54 ?

-

Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2015. Following are the correct balances at December 31, 2015, for the accounts both before and...

-

Robert Shapiro was the owner and CEO of Woodbridge, a supposed investment firm. Woodbridges main business model was to solicit money from individuals to invest in low-risk and conservative...

-

You are auditing general cash for the Pittsburgh Supply Company for the fiscal year ended July 31, 2011. The client has not prepared the July 31 bank reconciliation. After a brief discussion with the...

-

Part 1: How long does it take for an investment to double in value if it earns (a) 4%, (b) 6%, (c) 9%, (d) 12%, (e) 15% annual compound interest? Solve above using method of 1) Interpolation (Using...

-

Consider the European zero-rebate up-and-out put option with an exponential barrier: B() = Be , where B() > X for all . Show that the price of this barrier put option is given by where p E (S, ) is...

-

By applying the following transformation on the dependent variable in the BlackScholes equation while the auxiliary conditions are transformed to become Consider the following diffusion equation...

-

Classify each of the following as a sunk cost, an opportunity cost, or neither. a. The firm has spent $1 million thus far to develop the next-generation robotic arm; it is now examining whether the...

-

Under what circumstances are private entities exempted from tax payments?

-

What are the three main components of any queuing system?

-

Are tax shelters illegal? Why? Explain why tax shelters are different from tax havens.

-

What is the difference between tax avoidance and tax evasion? Why do individuals and businesses try to avoid or evade taxes?

-

What are the circumstances that gave rise to the laws of the nineteenth and twentieth centuries? How did the concept of financial stability shape the dimensions of US antitrust laws?

-

Brad and Judy Bailey both enjoy preparing food and creating new recipes. So they are taking their passion to the workplace and plan to open a new restaurant called Baileys. They have a two-year,...

-

suppose a nickel-contaminated soil 15 cm deep contained 800 mg/kg Ni, Vegetation was planted to remove the nickel by phytoremediation. The above-ground plant parts average 1% Ni on a dry-weight bas...

-

If sales promotion spending continues to grow often at the expense of media advertis inghow do you think this might affect the rates charged by mass media for advertising time or space? How do you...

-

As a community service, disc jockeys from radio station WMKT formed a basketball team to help raise money for local nonprofit organizations. The host organization finds or fields a competing team and...

-

How should the acceptance of a profit-oriented, a sales-oriented, or a status quooriented pricing objective affect the development of a companys marketing strategy? Illustrate for each.

-

A cache system has a 97% hit ration with an access time 2 nsec on a cache hit and an access time of 15 nsec on a cache miss (3%). What is the effective access time?

-

July 13: Made refunds to cash customers, $250, for defective merchandise. The cost of defective merchandise was $40. Journalize the refund. Do not record the expense related to the refund. We will do...

-

(1) How are artifacts related to EA components? Provide some examples of artifacts at the Applications and Services level of the EA 3 Cube Framework. What are some of the EA artifacts that would be...

Study smarter with the SolutionInn App