In the algebraic version of prospect theory, the variable x represents gains and losses. A positive value

Question:

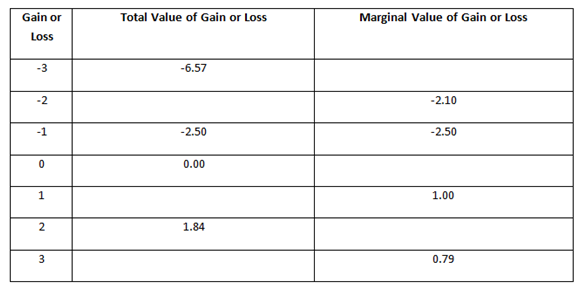

a. What is the total value of gaining $1? Of gaining $2?

b. What is the marginal value of going from gaining $0 to gaining $1? Of going from gaining $1 to gaining $2? Does the typical person experience diminishing marginal utility from gains?

c. What is the marginal value of going from losing $0 to losing $1? Of going from losing $1 to losing $2? Does the typical person experience diminishing marginal disutility from losses?

d. Suppose that a person simultaneously gains $1 from one source and loses $1 from another source. What is the person€™s total utility after summing the values from these two events? Can a combination of events that leaves a person with the same wealth as they started with be perceived negatively? Does this shed light on status quo bias?

e. Suppose that an investor has one investment that gains $2 while another investment simultaneously loses $1. What is the person€™s total utility after summing the values from these two events? Will an investor need to have gains that are bigger than her losses just to feel as good as she would is she did not invest at all and simply remained at the status quo?

Step by Step Answer:

Microeconomics Principles, Problems and Policies

ISBN: 978-1259450242

20th edition

Authors: Campbell R. McConnell, Stanley L. Brue, Sean Masaki Flynn