Fairchild Centre is an NFPO funded by govenunent grants and private donations. It was established on January

Question:

Fairchild Centre is an NFPO funded by govenunent grants and private donations. It was established on January 1, Year 5, to provide counselling services and a drop-in centre for single parents.

On January 1, Year 5, the centre leased an old warehouse in the central part of Small ville for $1,600 per month. It carried out minor renovations in the warehouse to create a large open area for use as a play area for children and three offices for use by the executive director and counsellors. The lease runs from January 1, Year 5, to June 30, Year 7. By that time, the centre hopes to move into new quarters that are more suitable for the activities carried out.

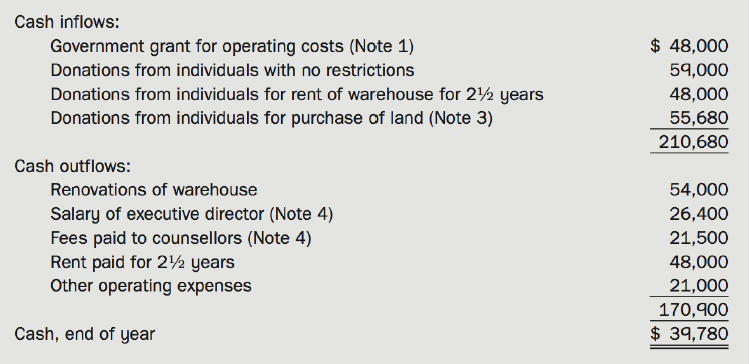

The following schedule summarizes the cash flows for the year ended December 31, Year 5:

Additional Information:

1. The provincial government agreed to provide an operating grant of $48,000 per year. In addition, the government has pledged to match contributions collected by the centre for the

purchase of land for construction of a new complex for the centre. The maximum contribution by the government toward the purchase of land is $96,000.

2. The centre has signed an agreement to purchase a property in the downtown area of Smallville for $216,000. There is an old house on the property, which is currently used as a rooming house. The closing date is any time between July 1, Year 6, and December 31, Year 6. The centre plans to demolish the existing house and build a new complex.

3. The centre has recently commenced a fundraising program to raise funds to purchase the land and construct a new building. So far, $55,680 has been raised from individuals toward the purchase of the land. In the new year, the centre will focus its efforts to solicit donations from businesses in the area. The provincial government will advance the funds promised under its pledge on the closing date for the purchase of the property.

4. All the people working for the centre are volunteers except for the executive director and the counsellors. The executive director receives a salary of $28,800 a year, while the counsellors bill the centre for professional services rendered based on the number of hours they work at the centre. The director has not yet received her salary for the month of December. One of the counsellors received an advance of $1,150 in December Year 5, for work to be performed in January year 6.

5. The centre wishes to use the deferral method of accounting for contributions and to segregate its net assets between restricted and unrestricted. It capitalizes the cost of capital assets and amortizes the capital assets over their useful lives.

Required

(a) State the assumptions necessary to recognize the pledge from the provincial government pertaining to the purchase of land, and prepare the journal entry to record the pledge, if applicable.

(b) Prepare a statement of operations for the Fair child Centre for the year ended December 31, Year 5. Show your supporting calculations and state your assumptions.

(c) Prepare a statement of changes in net assets for the Fair child Centre for the year ended December 31, Year 5.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell