On January 1, 2020, Bretz, Inc., acquired 60 percent of the outstanding shares of Keane Company for

Question:

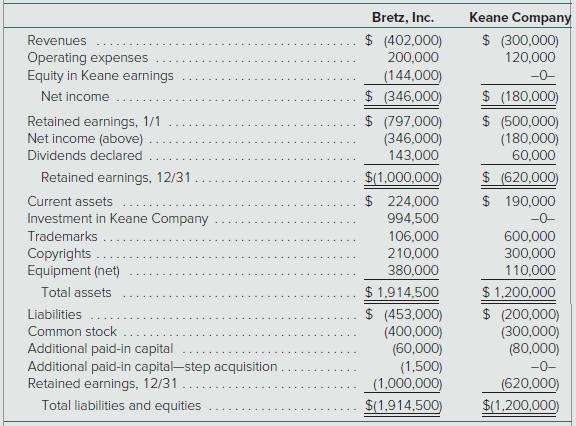

On January 1, 2020, Bretz, Inc., acquired 60 percent of the outstanding shares of Keane Company for $573,000 in cash. The price paid was proportionate to Keane’s total fair value although at the date of acquisition, Keane had a total book value of $810,000. All assets acquired and liabilities assumed had fair values equal to book values except for a copyright (six-year remaining life) that was undervalued in Keane’s accounting records by $120,000. During 2020, Keane reported net income of $150,000 and declared cash dividends of $80,000. On January 1, 2021, Bretz bought an additional 30 percent interest in Keane for $300,000.

The following financial information is for these two companies for 2018. Keane issued no additional capital stock during either 2020 or 2021. Also, at year-end, there were no intra-entity receivables or payables.

a. Show the journal entry Bretz made to record its January 1, 2021, acquisition of an additional 30 percent of Keane Company shares.

b. Prepare a schedule showing how Bretz determined the Investment in Keane Company balance as of December 31, 2021.

c. Prepare a consolidated worksheet for Bretz, Inc., and Keane Company for December 31, 2021.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik