Consider an economy where the dividends on the aggregate stock market are expected to grow at a

Question:

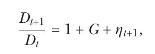

Consider an economy where the dividends on the aggregate stock market are expected to grow at a constant rate:

where \(\eta_{t+1}\) has mean zero and variance \(\sigma^{2}\).

The stochastic discount factor (SDF) in the economy can be written as

![]()

where the parameter \(k\) satisfies the restriction \(1 / k>1+G\).

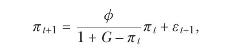

The state variable \(\pi_{t}\) determines the equity premium. It follows the process

where the shock \(\varepsilon_{t+1}\) is independent of the dividend growth shock \(\eta_{t+1}\).

(a) Write the coefficient \(k\) as a function of the riskless interest rate. Interpret the restriction \(1 / k>1+G\).

(b) Write an expression relating the price-dividend ratio, \(P_{t} / D_{t}\), to the expected time \(t+1\) SDF, price-dividend ratio, and dividend growth rate.

(c) Conjecture a solution for the price-dividend ratio of the form \(P_{t} / D_{t}=\alpha+\beta \pi_{t}\). Solve for the intercept \(\alpha\) and slope \(\beta\) of this relationship.

(d) Interpret the intercept you obtained in part (c).

(e) Interpret the slope you obtained in part (c). What is its sign? How does its magnitude depend on the persistence of the \(\pi_{t}\) process? Explain.

(f) What assumptions in this example make the price-dividend ratio linear in the state variable \(\pi_{t}\) even though the risk premium is time-varying? How might you generalize this example?

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell