Lustig, Stathopoulos, and Verdelhan (2016) investigate the profitability of carry-trade strategies with long-maturity bonds. One such strategy

Question:

Lustig, Stathopoulos, and Verdelhan (2016) investigate the profitability of carry-trade strategies with long-maturity bonds. One such strategy involves going long (short) longmaturity government bonds in currencies with high (low) local-currency term premia, that is, steep (flat) yield curves. They find that, across G10 countries, average returns to these strategies are close to zero, in sharp contrast to the high risk premia of the classic carry trade at the short end of the yield curve (with short-maturity bonds). \({ }^{13}\) Equivalently, they find that differences in long-term government bond risk premia expressed in the same currency are insignificant.

In this exercise we explore the implications of this finding for the comovement of marginal utility across countries under the assumption that international financial markets are complete.

(a) Show that the log risk premium (one-period-ahead expected excess log return) on a foreign long-maturity bond over the domestic riskfree rate expressed in domestic currency (US dollars) can be written as the the bond's log risk premium in local (foreign) currency plus the log risk premium on foreign exchange:

![]()

(b) Show that, when financial markets are complete, the difference between the dollar \(\log\) risk premium on infinite-maturity (zero-coupon) foreign bonds and the log risk premium on infinite-maturity domestic bonds is given by

![]()

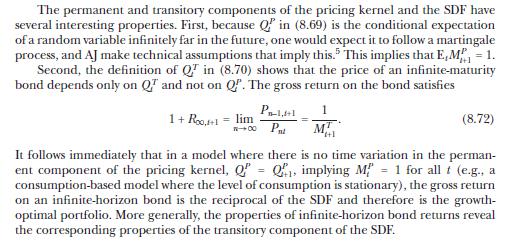

where \(L_{t}\left(M_{t+1}^{P}ight)-\left(L_{t}\left(M_{t+1}^{* P}ight)ight)\) is the entropy of the permanent component of the domestic (foreign) SDF, defined through the Alvarez and Jermann (2005) decomposition of the SDF discussed in section 8.4.2.

Conclude that transitory shocks to the SDF are irrelevant for the log risk premia of the carry trade with bonds of very long maturity.

(c) Explain the economic intuition behind this result by considering a world where there are no permanent innovations to the pricing kernel of any country. How do exchange rates and returns to infinite-maturity bonds respond if a country experiences unexpectedly high marginal utility growth relative to other countries?

(d) Suppose that the SDFs of all countries are exposed to the same set of global risk factors; for example, this exposure may be captured by an affine multifactor model as in section 8.3. However, countries may have asymmetric exposures to these factors (and there are no country-specific factors). Some of these factors only affect the permanent component of the SDFs, and the remaining ones affect only the temporary component of the SDFs. What assumption on countries' exposures to these sources of risk is consistent with the empirical finding that carry trade risk premia are high at the short end of the yield curve but become insignificant as bond maturity increases?

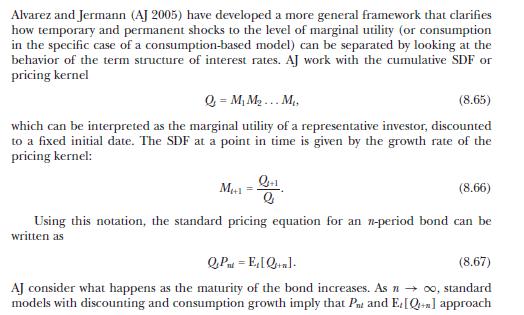

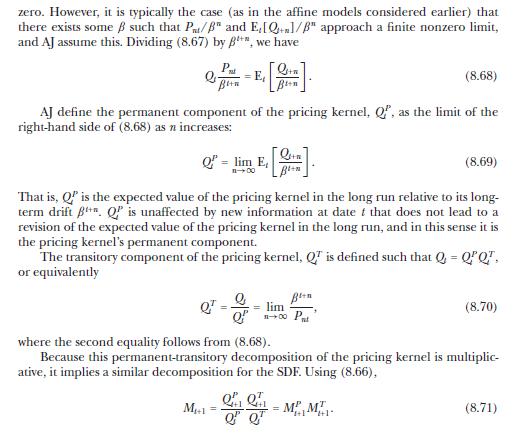

Data from 8.4.2

Data from section 8.3

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell