Reread the description of the FoodCo case study in Case Study B1. Identify any constraints that you

Question:

Reread the description of the FoodCo case study in Case Study B1. Identify any constraints that you think might be imposed on the design of the new system.

FoodCo Case Study:

FoodCo produces a range of perishable foods for supermarkets and is based in the flat

agricultural lands of the East Anglia region of the UK. John Evans, the present Chairman,

started the company when he left the Royal Air Force. He borrowed money to buy 200 acres

(81 hectares) of arable farmland, but his ambition was to be more than a farmer. As soon as

Home Farm was running he opened a factory in a converted barn.

The first product was a pickle made to a traditional family recipe. It sold well, and success

financed expansion. Soon John was able to acquire derelict land next to the farm and the

company moved into a larger, purpose-built factory. The product range extended to pre-packed

vegetables and salads, and later a wide range of sauces, pickles and sandwich toppings, in

fact almost anything made of vegetables that can be sold in jars. FoodCo’s traditional

customers are major UK supermarket chains. Some lines (e.g. washed salads) sell to all

customers, while others (most of the cooked products) are produced for a specific supermarket

chain. Most are packaged under the supermarket’s ‘own brand’ label.

The pickle started a company tradition that, as far as possible, ingredients are grown on the

company’s own farm. This now covers 1500 acres (607 hectares) and includes a market

garden growing tomatoes, peppers, courgettes, chillies and other exotic vegetables under

glass, and an extensive herb garden. Ingredients that do not grow well in the UK climate are

sourced from carefully selected farms abroad, in Mediterranean Europe, East Africa, the USA

and the Far East.

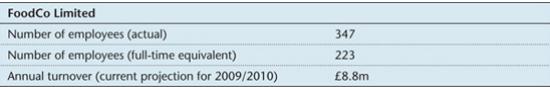

The company’s annual turnover and employee numbers are summarized in Fig. B1.1.

Figure B1.1:

There are now three factories on the site. Beechfield is the oldest, and this is where raw

vegetables are prepared. This work is relatively unskilled. The newer Coppice and Watermead

factories concentrate on the more complex cooking processes involved in making sauces,

pickles and the like. These need more skilled and experienced staff. A bottling plant is also

located in Watermead, and there are two warehouses in separate buildings. One is

refrigerated and stores fresh vegetable and salad packs, while the other stores dry and bottled

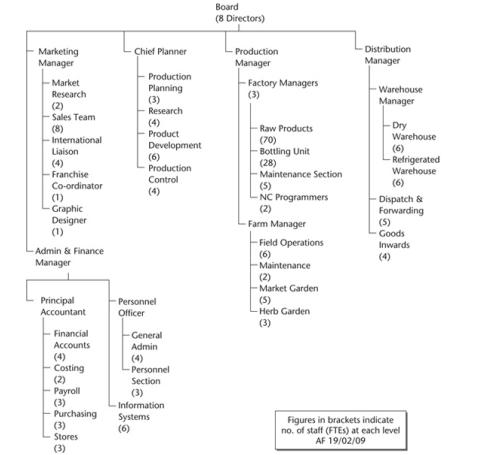

products. Figure B1.2 shows a recent organization structure chart.

Figure B1.2:

The company is still privately owned and managed, with John’s elder son Harold now the

The company is still privately owned and managed, with John’s elder son Harold now the

Managing Director and John keeping more in the background. When Harold took over, it was

generally agreed by the Board that the company must improve profitability but there was no

consensus on how to achieve this. John persuaded the Board that FoodCo must bypass its

traditional supermarket customers and market directly to consumers. As a result of his analysis

(Box B1.1 gives an edited version of his last speech to the Board as Managing Director), the

‘World Tradition’ range was launched. This now sells successfully at the quality end of the UK

market. Helped by the growing respect for British food and cooking, the range has also begun

to penetrate continental European and North American markets.

Box B1.1:

‘Fellow directors, we all know the company faces great difficulties. This year’s profits will be the

lowest ever. If we don’t do something drastic, we’ll be bankrupt in another year. But if we are to turn. the situation round, we must understand why things are so difficult for us now.

‘I believe the reason goes right back to our beginnings. Those of you who were with me in 1967,

when I started this company, will remember having a degree of control that seems incredible now.

Everything ran the way we wanted: farm, production, sales, distribution. We made consistently high

quality goods, and by 1972 the new supermarkets were clamouring to buy. That was all a long time

ago, but I think that early success is a direct cause of our present predicament. Let me explain.

‘But remember 1978? When we borrowed heavily to finance expansion to meet the demand?

Those loan repayments squeezed our profits hard. And then in 1984? When the TrustMart chain

emerged as our dominant customer, and began driving down prices? We simply hadn’t the financial

muscle to fight them. We were still paying off a huge loan! Ever since then, TrustMart has dictated

prices so low they have crippled us. We’ve been unable to do a thing about it, because we’ve

simply been scared they’ll go to our competitors for their supplies. Last year TrustMart bought 65%

of our total production—altogether over £5m in sales—and we’ll be lucky to clear £200,000 profit on

it!

‘That’s also why TrustMart calls all the shots on new products. We don’t have the cash to

develop products for other customers. Now, I know we’ve grown in spite of that. It’s not all been

bad, but let’s not kid ourselves it’s been good. We haven’t really run the game since 1990. We all

know it! We’ve been towed along behind TrustMart—and the supermarket sector—like a child

dragged along by its father. We’ve only survived this long because TrustMart had no other suppliers

big enough to meet their needs. But now that’s changing. We have serious new rivals for the

supermarket supply business, and TrustMart has driven our prices still lower, to the point where we

may make no profit at all this year.

‘We can beat off this attack, but only if we develop new products and sell in a wider market.

There is no argument about that, but there is a problem. Our real customers are not the

supermarkets, but their shoppers. And they don’t know we exist, because our name is hidden

behind all the TrustMart own-brand labels on all our packs and jars. The answer is to reach the

consumers directly. Our market can only expand if they know our name, if they ask for our

products. So here’s what we will do. We’re going to launch our own brand name, and promote it so

well that everyone knows about us. Customers will begin to insist on our brand, and TrustMart will

have to pay our price, for a change.

‘It won’t be cheap. We’ll need serious market research. We’ll need more staff in the Product

Development team, and we’ll need time. We’ll need a new corporate image. We’ll need TV

advertising. But it will be worth it. There’s a vast market out there, and I’m not just thinking of the

UK.

‘So can we finance it? Certainly! It means more heavy borrowing, but our profits on increased

sales will repay the loan. It’s a big risk, but we’ll sink if we don’t take it. There are many details to

work out, but this plan can succeed. It will succeed! When I started out, we were the best in the

business. I believe we can be the best again.

Step by Step Answer:

Object-Oriented Systems Analysis And Design Using UML

ISBN: 9780077139711

4th Edition

Authors: Simon Bennett, Steve McRobb, Ray Farmer