Preparing an Individuals Tax Form. Caleb Lee graduated from college in 2018 and began work as a

Question:

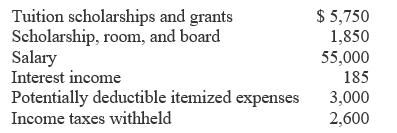

Preparing an Individual’s Tax Form. Caleb Lee graduated from college in 2018 and began work as a systems analyst in July of that year. He is preparing to file his income tax return for 2018, and has collected the following financial information for calendar year 2018. A blank Form 1040 and Schedule 1 may be obtained at www.IRS.gov.

a. Prepare Caleb’s tax return, using a $12,000 standard deduction and the tax rates given in Exhibit. Assume Caleb is single and his tuition scholarships and grants are nontaxable (do not exceed tuition), but his room and board scholarship is taxable.

b. Prepare Caleb’s tax return using the data in part a, along with the following information:

Step by Step Answer:

Personal Financial Planning

ISBN: 9780357438480

15th Edition

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk