Every 6 months, Sean Ma takes an inventory of the consumer debts that he has outstanding. His

Question:

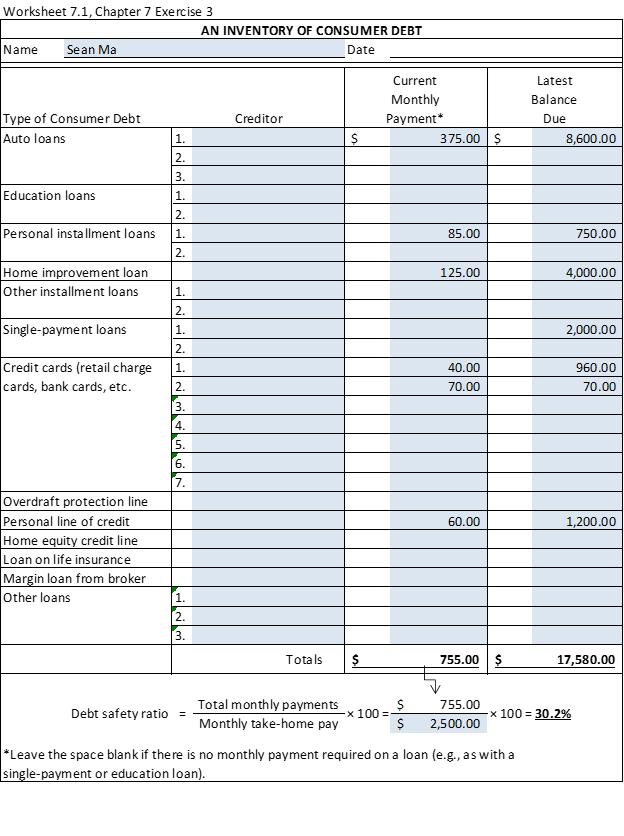

Every 6 months, Sean Ma takes an inventory of the consumer debts that he has outstanding. His latest tally shows that he still owes $4,000 on a home improvement loan (monthly payments of $125); he is making $85 monthly payments on a personal loan with a remaining balance of $750; he has a $2,000, secured, single-payment loan that’s due late next year; he has a $70,000 home mortgage on which he’s making $750 monthly payments; he still owes $8,600 on a new car loan (monthly payments of $375); and he has a $960 balance on his MasterCard (minimum payment of $40), a $70 balance on his Exxon credit card (balance due in 30 days), and a $1,200 balance on a personal line of credit ($60 monthly payments). Use Worksheet 7.1 to prepare an inventory of Sean’s consumer debt. Find Sean’s debt safety ratio given that his take-home pay is $2,500 per month. Would you consider this ratio to be good or bad? Explain.

Step by Step Answer:

Personal Financial Planning

ISBN: 9780357438480

15th Edition

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk