The average asset beta for the pure players in this industry, Relevant, ABJ, and Opus, weighted by

Question:

The average asset beta for the pure players in this industry, Relevant, ABJ, and Opus, weighted by market value of equity is closest to:

A. 1.67.

B. 1.97.

C. 2.27.

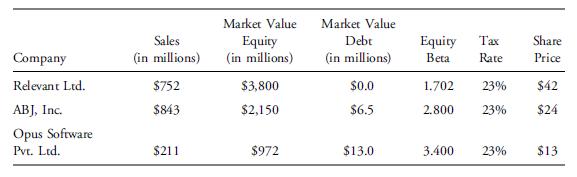

Boris Duarte, CFA, covers initial public offerings for Zellweger Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of TagOn, a U.S.-based business intelligence software company. The industry has grown at 26 percent per year for the previous three years. Large companies dominate the market, but sizable “pure-play” companies such as Relevant, Ltd., ABJ, Inc., and Opus Software Pvt. Ltd also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the U.S. NASDAQ. The debt ratio of the industry has risen slightly in recent years.

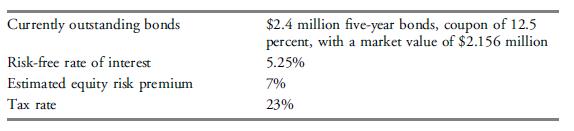

Duarte uses the information from the preliminary prospectus for TagOn’s initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between \($7\) and \($12\).

The current capital structure of TagOn consists of a \($2.4\) million five-year noncallable bond issue and 1 million common shares. Other information that Duarte has gathered:

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan