Cosmetic Manufacturers is contemplating changing the capital structure of the firm. The firm has $45,000,000 in total

Question:

Cosmetic Manufacturers is contemplating changing the capital structure of the firm. The firm has $45,000,000 in total assets, earnings before interest and taxes of $8,500,000, and is taxed at a rate of 40%.

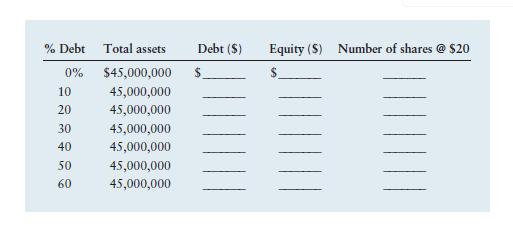

a. Complete the following table showing the values of debt, equity, and the total number of shares of common stock. The book value is $20 per share.

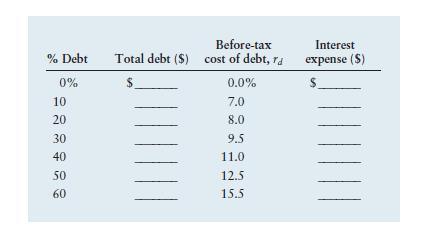

b. Complete the following table indicating the total debt and interest expense for each level of indebtedness.

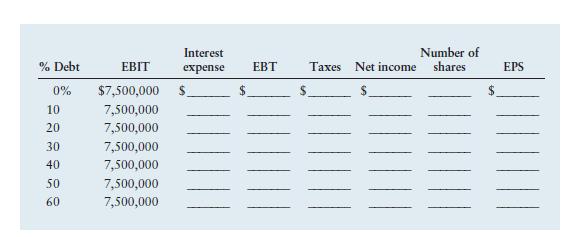

c. Using an EBIT of $7,500,000, a 40% tax rate, and the information developed in parts a and b, calculate the most likely earnings per share (EPS) for the firm at each level of indebtedness.

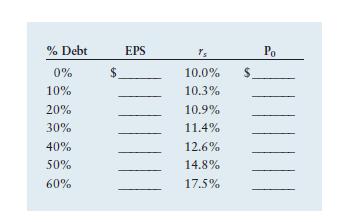

d. Complete the following table showing the estimates of the value per share at various levels of indebtedness. The estimates of required return are denoted by rs.

e. Based on your answer in the previous parts, which debt ratio would you recommend? Explain your answer.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter