Dyno Corporation has two projects that it would like to undertake. However, due to capital restraints, the

Question:

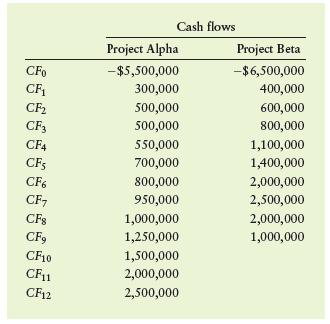

Dyno Corporation has two projects that it would like to undertake. However, due to capital restraints, the two projects—Alpha and Beta—must be treated as mutually exclusive. Both projects are equally risky, and the firm plans to use a 10% cost of capital to evaluate each. Project Alpha has an estimated life of 12 years, and project Beta has an estimated life of nine years. The cash flow data have been prepared as given in the following table.

TO DO

Create a spreadsheet to answer the following questions.

a. Calculate the NPV for each project over its respective life. Rank the projects in descending order on the basis of NPV. Which one would you choose?

b. Use the annualized net present value (ANPV) approach to evaluate and rank the projects in descending order on the basis of ANPV. Which one would you choose?

c. Compare and contrast your findings in parts a and b. Which project would you recommend that the firm choose? Explain.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart