Godiva Chocolatier is considering one of three mutually exclusive projects for opening a chocolate factory in Bruges,

Question:

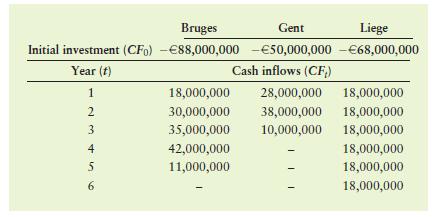

Godiva Chocolatier is considering one of three mutually exclusive projects for opening a chocolate factory in Bruges, Gent, or Liege. The firm plans to use a 10% cost of capital to evaluate these equal-risk projects. The initial investment and annual cash inflows over the life of each project are given in the following table

a. Calculate the NPV for each project over its life. Rank the projects in descending order on the basis of NPV.

b. Use the annualized net present value (ANPV) approach to evaluate and rank the projects in descending order on the basis of ANPV.

c. Compare and contrast your findings in parts a and b. Which project would you recommend that the firm accept? Why?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart