Novartis International AG has warrants that allow the purchase of five shares of its outstanding common stock

Question:

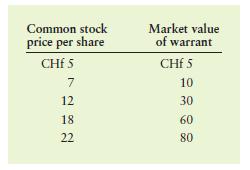

Novartis International AG has warrants that allow the purchase of five shares of its outstanding common stock at CHf 7 per share. The common stock price per share and the market values of the warrant associated with that stock price are shown in the table.

a. For each of the common stock price given, calculate the theoretical warrant value.

b. Graph the theoretical and market values of the warrant on a set of axes with per share common stock price on the x-axis and warrant value on the y-axis.

c. Assume that the warrant value is CHf 15 when the market price of common stock is CHf 8. Does that contradict or support the graph you constructed? Explain.

d. Specify the area of warrant premium. Why does this premium exist?

e. If the expiration date of the warrants is quite close, would you expect your graph to look different? Explain.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart