Wesfarmers, an Australian conglomerate, is considering investing in a project that has the following unusual cash flow

Question:

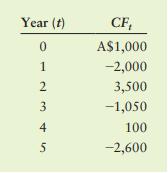

Wesfarmers, an Australian conglomerate, is considering investing in a project that has the following unusual cash flow pattern.

a. Calculate the project’s NPV at each of the following discount rates: 0%, 5%, 10%, 20%, 30%, and 50%.

b. What do the calculations tell you about this project’s IRR? The IRR rule tells managers to invest if a project’s IRR is greater than the cost of capital. If Wesfarmers’ cost of capital is 12%, should it accept or reject this investment?

c. According to you, what is the best way to make decisions for projects with unusual cash flows?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: