Woolworths Ltd. is evaluating the feasibility of investing A$1,000,000 in a new store in Sydney, having a

Question:

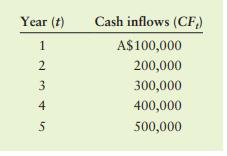

Woolworths Ltd. is evaluating the feasibility of investing A$1,000,000 in a new store in Sydney, having a 5-year life. The firm has estimated the cash inflows from the proposed store, as shown in the following table. The firm has an 8% cost of capital.

a. Calculate the payback period for the proposed investment.

b. Calculate the net present value (NPV) for the proposed investment.

c. Calculate the internal rate of return (IRR), rounded to the nearest whole percent, for the proposed investment.

d. Evaluate the acceptability of investing in the store using NPV and IRR. What recommendation would you make relative to the implementation of the project? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: