Johnson & Barkley, CPAs, audited the consolidated financial statements of Jordan Company for the year ended December

Question:

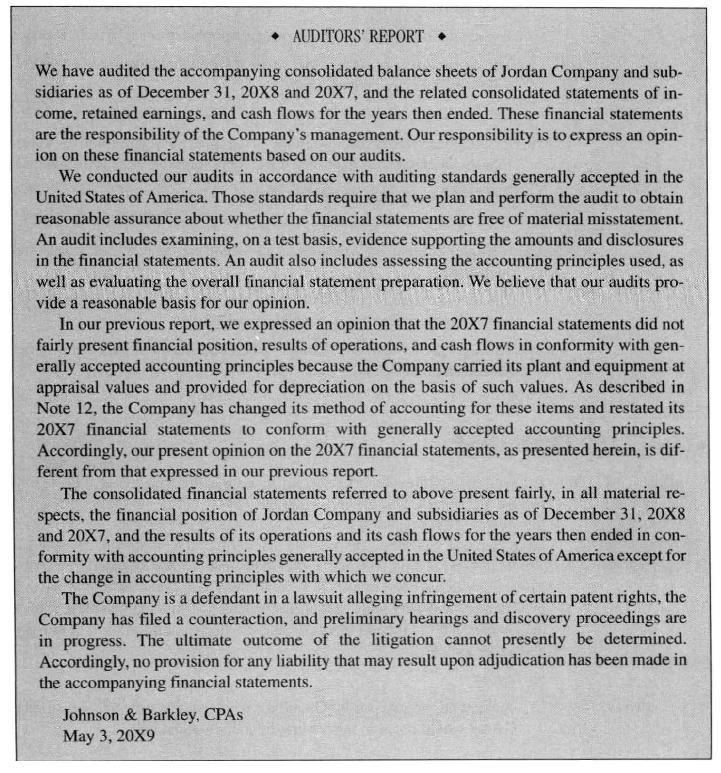

Johnson & Barkley, CPAs, audited the consolidated financial statements of Jordan Company for the year ended December 31, 20X7, and expressed an adverse opinion because Jordan carried its plant and equipment at appraisal values and provided for depreciation on the basis of such values.

Johnson & Barkley also audited Jordan's financial statements for the year ended December 31, 20X8. These consolidated financial statements are being presented on a comparative basis with those of the prior year and an unqualified opinion is being expressed.

Smith, the engagement supervisor, instructed Abler, an assistant on the engagement, to draft the auditor's report on May 3, 20X9, the date of completion of the fieldwork. In drafting the report below, Abler considered the following:

- Jordan recently changed its method of accounting for plant and equipment and restated its \(20 X 7\) financial statements to conform with GAAP. Consequently, the CPA firm's present opinion on those statements is different (unqualified) from the opinion expressed on May 12, 20 X9.

- Larkin & Lake, CPAs, audited the financial statements of BX, Inc., a consolidated subsidiary of Jordan, for the year ended December 31, 20X8. The subsidiary's financial statements reflected total assets and revenues of 2 percent and 3 percent, respectively, of the consolidated totals. Larkin \& Lake expressed an unqualified opinion and furnished Johnson & Barkley with a copy of the auditor's report. Johnson & Barkley has decided to assume responsibility for the work of Larkin \& Lake insofar as it relates to the expression of an opinion on the consolidated financial statements taken as a whole.

- Bond is a defendant in a lawsuit alleging patent infringement. This is adequately disclosed in the notes to Jordan's financial statements, but no provision for liability has been recorded because the ultimate outcome of the litigation cannot presently be determined.

Required: Smith reviewed Abler's draft and stated in the Supervisor's Review Notes below that there were deficiencies in Abler's draft. Items 1 through 15 represent the deficiencies noted by Smith. For each deficiency, indicate whether Smith is correct or incorrect in the criticism of Abler's draft.

1. The report is improperly titled.

2. All the basic financial statements are not properly identified in the introductory paragraph.

3. There is no reference to the American Institute of Certified Public Accountants in the introductory paragraph.

4. Larkin & Lake are not identified in the introductory and opinion paragraphs.

5. The subsidiary, BX Inc., is not identified and the magnitude of BX's financial statements is not disclosed in the introductory paragraph.

6. The report does not state in the scope paragraph that generally accepted auditing standards require analytical procedures to be performed in planning an audit.

7. The report does not state in the scope paragraph that an audit includes assessing internal control.

8. The report does not state in the scope paragraph that an audit includes assessing significant estimates made by management.

9. The date of the previous report (May 12, 20X8) is not disclosed in the first explanatory paragraph.

10. It is inappropriate to disclose in the first explanatory paragraph the circumstances that caused Johnson \& Barkley to express a different opinion on the 20X7 financial statements.

11. The fourth paragraph should begin with "In our opinion."

12. The concurrence with the accounting change is inappropriate in the opinion paragraph.

13. Uncertainties may no longer be mentioned in explanatory paragraphs and that paragraph must be deleted.

14. The letter of inquiry to Jordan's lawyer concerning litigation, claims, and assessments is not referred to the second explanatory paragraph.

15. The report is not dual dated, but it should be because of the change of opinion on the \(20 \mathrm{X} 7 \mathrm{fi}-\) nancial statements.

Step by Step Answer:

Principles Of Auditing And Other Assurance Services

ISBN: 9780072327267

13th Edition

Authors: Ray Whittington, Kurt Pany